We have started the coverage of a non-benchmarked, total return emerging market debt fund. We think this wrapper is best suited to exploit the heterogeneous and wide Emerging Market Debt universe.

Fully flexible and opportunistic

The fund employs a flexible an opportunistic approach across the entire spectrum of EMD, i.e hard and local currency debt, and currencies. The strategy is also flexible between EM sovereign, quasi-sovereign and corporate bonds. However, historically the fund has been mainly invested into hard currency Sovereigns.

The fund invests across the full credit spectrum from Investment Grade to High Yield and distressed debt. The fund has very limited constraints and it can invest with a large leeway in the all the sub-assets class, ratings, and outside the EMD benchmarks.

Two stage investment process

The investment process is split into 2 independent sleeves. The macro exposure and the specific stories.

The global macro analysis determines the portfolio’s overall exposure to market risk and beta. It expresses the preference in terms of asset class, region, sector or instrument types. The specific analysis aims to identify the most compelling ideas within the investment universe on absolute and relative to implement the set of the strongest investment convictions. At this stage, they are very selective in investment themes and idiosyncratic stories to build a diversified fund.

The strategy is not purely fundamental but it also integrates a strong focus on flows, market participants positioning and valuations with a contrarian mindset. The aim is to avoid fundamental and benchmark biases as well as herd behaviour.

The final portfolio comprises maximum 20 sub-strategies with 3 types of risk positions to focus on the best asymmetrical risk/reward. The Fund is truly unconstrained with very low correlation with EMD indices and best peers.

The distinctive features of the strategy

- High alpha, flexible and unconstrained approach that navigates opportunistically across the full EMD spectrum to invest in the strongest investment opportunities

- The robust risk framework through market exposure management, active hedging strategies and particular attention given to liquidity of the portfolio

- A combination of fundamental factors and technical analysis following a contrarian approach: fundamental factors only account for half of the macro-economic and specific analysis.

- A conviction-led and a market lever to adapt to all types of market cycles

Performances

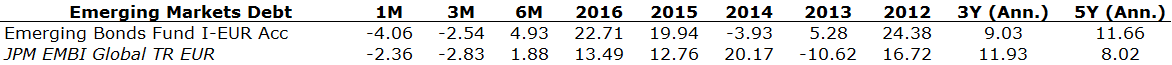

As the fund is truly unconstrained, the performance can deviate significantly from its benchmark as shown in 2013 and 2014. This is often the result of contrarian positioning or early investments in specific exposure such as in Argentina, Belize, Indonesia or Russia over the last four years.

Overall, the strategy is more volatile than the benchmark and peers but it ranks in the top decile with high consistency over the medium term.

Source: WSP using Morningstar Direct as of 31.05.2017, institutional share class in EUR