The Latin America equity peer-group is tough to outperform by an actively managed fund. If you add the sector bias towards banks and materials, the country weight toward Brazil and Mexico that represents more than 80% of the benchmark, and the narrow opportunity set in terms of liquid companies, it makes it really hard for portfolio managers to consistently generate alpha through a full economic cycle, unless they stick to the benchmark.

To access this asset class, we recently initiated a coverage on a fund managed by a UK boutique launched in 2010. They are Emerging and Frontier Markets specialists with slightly more than USD 200mn of AUMs. The investment process implemented is unconstrained and homogeneous for the five UCITS funds managed by this Asset Manager.

Forward looking ESG analysis and protection on downward markets

We like the thematic overlay and the inputs used to identify long-term themes. Once themes are set, they will drive the top-down analysis, staying focused on the next cycle of domestic growth. We think the investment team, led by one of the most experienced Portfolio Manager (PM) in this region, displays above average knowledge and depth in research to assess the structural growth drivers and country risks. From a stock picking standpoint, they focus on companies with sustainable competitive advantage and they perform rigorous financial analysis and modelling. More importantly, the PM has integrated a forward looking ESG analysis to define the investment universe with the aim to drive best practices and improvement in corporate governance within the region.

The aim of the strategy is to protect on downward markets and achieve better drawdown than its peers. The fund has well achieved on these objectives by exhibiting the lowest down capture ratio of its peer group over the last 3 years, at 50%. Beta of the portfolio is currently 0.56, thus the fund is expected to lag its benchmark in strong market rally, and it did so. Investments are made with a 3 to 5 years’ time horizon, turnover standing on average at around 25%.

High conviction-led portfolio

The investment process results in a very high conviction-led portfolio of 30 stocks on average, characterised by long term themes and quality holdings. The fund is fully benchmark agnostic with an active share of around 90%. Compared to peers the fund exhibits a very low overlap with a very distinctive set of holdings.

The portfolio is skewed towards domestic themes and the companies that can capture them over the long run, particularly in the mid-caps space. The resulting portfolio is concentrated around best ideas with a sector exposure biased towards long term macro themes and quality. Finally. Zero allocation will be allowed into fundamentally incompatible sectors or business practices.

The fund is heavily overweight the domestic consumption theme (food & beverages, transportation, capital goods and retail) whilst significantly underweight in cyclicals (energy, materials and financials).

Country and Industry Group Allocations

Source: Fund Manager, September 2017

Robust track record

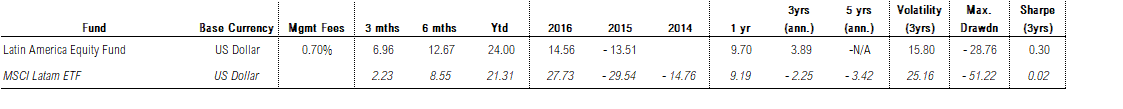

The track record since inception in May 2014 has been robust. The fund exhibits high risk adjusted return profile with much lower volatility than the peer group. The AUM of the strategy is growing steadily but remains low which require to be closely monitored. The fund is suitable for structural investors in the asset class, willing to gain exposure to secular domestic-oriented investments with a truly embedded ESG approach.

Performance Data Table