As one of the most mispriced asset classes, emerging markets small cap provides an abundant source of alpha for investment managers with the skill and resources to unlock the opportunity. Since 2001, the emerging markets small caps have outperformed their large cap peers, but without higher volatility.

Active systematic stock selection

In addition to the beta derived from exposure to the asset class, active managers have an opportunity to capture alpha by taking advantage of greater idiosyncratic risks in the small cap segment. They may overweight selected securities that demonstrate promising growth stories. An active, systematic stock selection approach based on fundamental analysis can consistently deliver above average risk-adjusted returns compared to the emerging large caps. This is mainly achieved because of the low coverage of those companies by sell side analysts. More than 500 companies are covered with less than one analyst, often a local one in this asset class. This is then an unprecedented hunting ground for global Asset Managers able to develop on the ground offices and resources for stocks research.

A vast and diverse investment universe

The investment universe is vast with more than 22.000 stocks of less than 2 billion of market capitalisation, and a daily turnover of 53 billion USD (equivalent to the MSCI EM index) for a total market capitalisation of nearly 6 billion USD. This create a large opportunity set for stock pickers to exploit inefficiencies and find excellent risk/reward profiles.

Moreover, historically Emerging Markets small caps have been a very good complemented existing Emerging Markets exposure given its sector composition tilted towards consumers discretionary and industrials, while GEM index has a clear bias towards Information Technology and Financials.

From a portfolio construction standpoint, Emerging Markets small caps are a very good diversifier to gain exposure to high growth stories, four times at least the sales growth of the MSCI World Index with very reasonable valuation metrics

Superior risk-adjusted return

Historically, investing in Emerging Markets small caps has delivered superior risk-adjusted returns with higher performance, but surprisingly with much lower volatility and downside risk. This is mainly due to the low coverage as stated before, low exposure and limited ownership by international investors.

Our best fund pick

Our best pick is from an Asset Manager that has been a pioneer in investing into Emerging and Frontier markets with more than 20 years of track record in the asset class.

It has one of the largest Global Emerging Markets team in the industry with 50 investment professionals spread across 20 offices. This local presence and resources are key to execute well on stock research and analyst coverage. It gives direct access to management, enhancing company visits which are at the core of the investment process. Portfolio construction is purely bottom-up, stock specific and influenced more by a thematic overlay than by the benchmark.

The strategy benefits from several full-cycle-tested investment philosophy and process based on disciplined valuation assessment and long-term investing. The strategy displays a global presence with experienced and stable research team with an extensive and continuous coverage of the Emerging Market small caps universe.

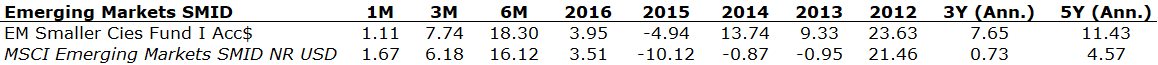

The fund exhibits one of the best risk-adjusted returns of its peer group, with the lowest down capture ratio and lowest maximum drawdown whilst generating the highest Sharpe and Sortino ratios. The fund is top decile and it has outperformed its benchmark for the last 5 years both in up and down markets.

Source: WS Partners, Morningstar, Fund Manager as of 31 May 2017