In our quest to uncover funds managing successfully risk premia factor as a source of superior return away from traditional risk exposures, we have come across a team with a solid experience in managing a fund in alternative risk premia.

As a matter of refresh, the risk premium is the return expected by investors to hold a risky asset. Alternative risk premia, that oppose to traditional risk premia we encounter when taking directional market risk, has become more evident over the recent years, identified by academic research. It encompasses a broader set of other sources of systematic returns. The most well-known are emanating from the Fama-French factors; market, value, and size. The aim of investment into alternative risk premia is to provide a diversified return stream away from long exposure into bonds and stocks.

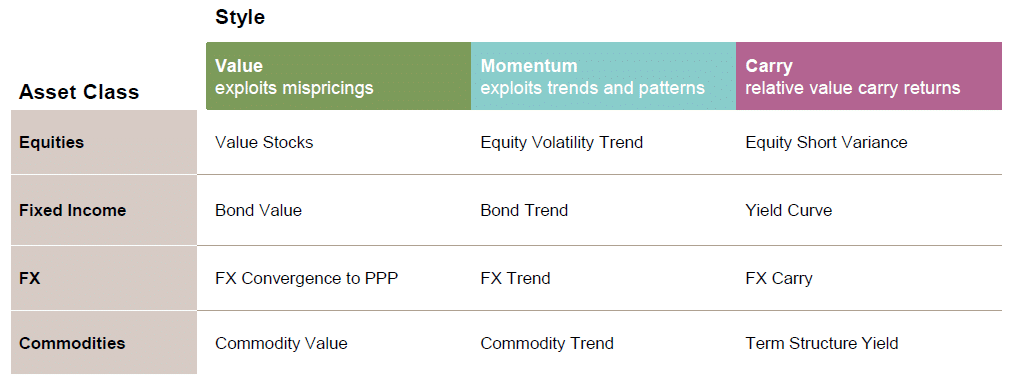

The fund managers we review in this note use only 3 alternative factors; value momentum and carry, which the fund managers try to exploit the associated risk premia in 4 broad asset classes; equities, fixed income, forex, and commodities.

In the equity value stocks (see below), the fund managers consider four markets; US, Japan, Europe and UK.

Source: WS Partners, Fund Management Company

Value

The rationale behind value is to invest in assets undervalued relative to their fair value, in the expectation mispriced securities tend toward fair value over time.

Momentum

Seek to exploit the tendency for price trends to exhibit persistency. Recognition of such momentum relies on high autocorrelation of returns, which tends to occur in capital markets.

Carry

Aim at extracting the excess yields of assets with higher income streams vs others with lower income streams. It is achieved by investing into higher yielding assets while shorting the lower yielding ones.

The fund’s portfolio managers have identified a set of premia across factors, sectors and asset classes to optimise their portfolio against them.

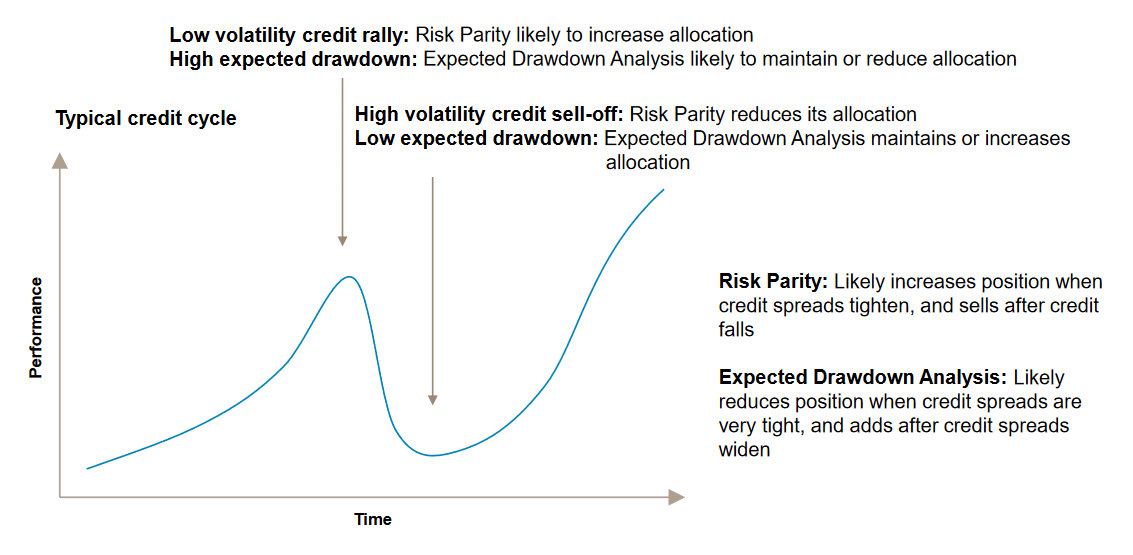

They use a proprietary analysis on expected drawdown to size and manage the portfolio’s risk. It represents an improvement to the traditional risk parity approach according to them, and it is indeed their key differentiating factor to peers. The goal is to reduce allocation into rallying assets, in order to mitigate subsequent drawdowns. In the same circumstances, the traditional risk parity tends to increase the allocation, encouraged by the prevailing lower volatility regime during rallies, while reducing the allocation after a correction occurred, driven by the resulting increase in volatility.

Herebelow chart illustrates how both approaches differ and the expected drawdown analysis aim at add value in extreme market conditions.

Source: WS Partners, Fund Management Company

… the main objective of this risk premia fund is to enhance diversification to a current portfolio, targeting low correlation to equities and bonds with a return objective over a market cycle of cash +4%-5% per annum with a 4-5% volatility.

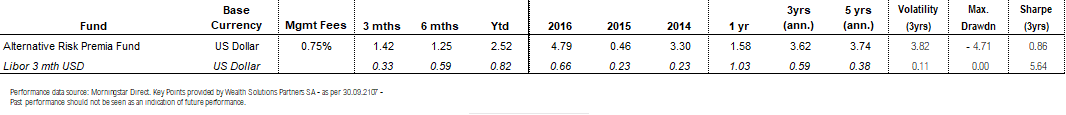

Over a 3 years observation period, we have found that the portfolio has generated an annualised return (net of fees) of 3.6% with a volatility of 3.2%, hence slightly short of its risk adjusted return objective. To compare, a good long/short equity funds, or a global convertible bond fund have realised similar performances but at twice the volatility of the risk premia fund.

We have the fund in our Watch list and will follow closely this strategy. Before adding it to our selection list we would like to go through market conditions able to stress test the fund’s expected drawdown analysis, which is a core component to the portfolio risk adjusted return success. The prolonged period we have had so far, of limited correction, and low volatility regime, in almost every asset classes the fund trades, makes very difficult to assess the benefit of their risk premia model yet.