We decided to introduce a Capital Securities strategy, mainly invested in Subordinated Financials of European banks, into our Master List as well as in our Model Portfolio. As such it highlights the fact that we see Capital Securities as an asset class on its own with its specific drivers and catalysts. We expect the asset class to remain an attractive investment case in the current credit environment.

Macroeconomic Outlook

According to the Portfolio Manager, a number of things have changed in terms of the macro backdrop. About a year ago, the market was in the centre of the storm particularly for banks equities. The key reasons for that were fear of deflation and the belief that the ECB was going to stay lower for longer. These fears have now receded, starting with the steepening of the yield curve and continued by the ECB announcement it would reduce the amount of bonds purchased from EUR 80 billion a month to EUR 60 billion. A second point on bank equities is that the regulatory cycle is slowing down. For instance, Basel IV will likely be less punitive than expected.

Microeconomic environment: Deleveraging – Balance-sheet improvements

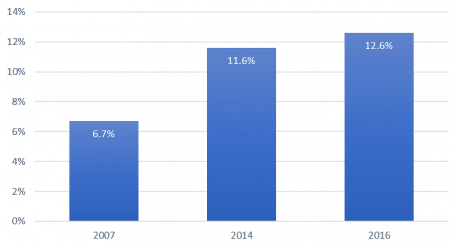

Banks have strengthened risk weighted measures of capital and Core Tier 1 ratios for global banks at 8-12% is well above the 7% minimum capital requested by Basel III.

Average CET1 for Developed Market Banks

Source: WS Partners, PIMCO as of 31 December 2016 based on Q4 16 results of the major developed banks

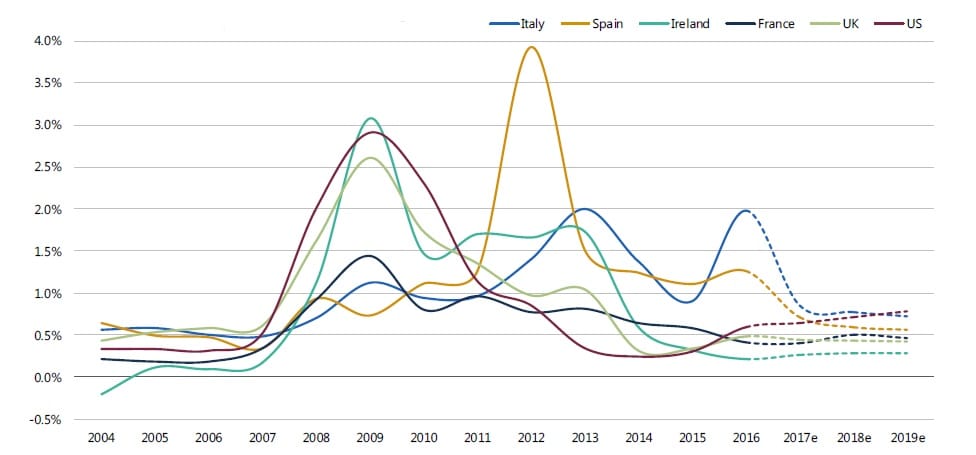

Loan loss provisions normalized over the past few years, decreasing the cost of risk for European banks to the same level to those of the US banks. A similar boost of profitability is therefore expected for European banks.

Cost of risk (loan-loss provisions as % average loans)

Source: Morgan Stanley Research based on Q4 16 results

Although the capital increase of both banks, Deutsche Bank and UniCredit, have been successful, the Portfolio Manager remains prudent towards German and Italian banks, favouring Spanish and Irish ones. He also keeps his exposure to Swiss and UK banks where capital compression is expected to continue. Finally, he took some profit on US banks, Senior and Subordinated, for valuation reasons.

Political risks

Political uncertainties have been and will stay the main factor of instability for this politically very sensitive asset class. The year 2016 teaches us that we should be very humble about making political forecasts and even if the forecast is correct there are still chances to make the wrong decision. The election calendar will concentrate in Europe this year and the French election will by far the most heavily watched. For that reason, the Portfolio Manager decided to marginally increase the level of cash at the beginning of the year as well as to increase the portfolio exposure to the safest part of the capital structure. We expect the manager to increase quite aggressively the risk in its portfolio, should the result of the French election be positively viewed by the financial markets.

Valuation

Subordinated Financials provide attractive yields relative to other credit asset classes….

Yield to Worst across Debt markets

Source: WS Partners, Pimco

… and relative to other part of the capital structure. In comparison Senior Bank debt are trading at highly tightened spreads and bank’s equities are at high multiples. Yet, despite those strong signals at both end of the capital structure, hybrid securities are still trading at yields over 6%, highlighting a pricing anomaly.

Moreover, bank capital

- Is a valid alternative to diversify traditional investment grade (correlation of 0.4), high yield (0.7) credit strategies.

- Has negative correlation with interest rates (-0.1 with US Treasury), serving as an indirect hedge to potential increase in interest rates.

In our opinion the bank debt evolves with its own market catalysts and risks. Its moderate correlation to traditional corporate credit justifies that we reckon it as an asset class on its own. We therefore have decided to introduce a Capital Securities strategy on our selection list through a fund managed by a pioneer in subordinated financials investment. A critical factor in our choice has been the size of the team dedicated to financial debt. Due to the complexity of the Subordinated Financial market, the variety of jurisdiction, and as the devil is in the details of the issuers prospectus, a critical mass of analysts resource is required.

Moreover, due to the favorable macroeconomic environment for banks as well as the improvement of their fundamental figures we recently increased our exposure to Subordinated Financials in our different Model Portfolios. As we mentioned in a previous newsletter, we currently favor “niche” strategies like Loans and Subordinated Financials to traditional Corporate HY or IG, where spreads are artificially compressed by the ECB bonds purchased program.