The universe of funds claiming an absolute return objective has grown over the recent years in assets and by the diversity of strategies available. It is primarily in reaction to the increasing appetite for high returns adjusted to risk in an environment of persistently ultra-low yielding bonds while stocks are reaching stretched valuations.

The source of return these fund managers try to exploit is highly diverse, most are made of traditional portfolios with layers of hedging strategies to reduce or neutralise the portfolio volatility, but little are genuine alternative strategies based on the latest finding in asset allocation, behavioural finance or advanced portfolio management theory.

From Gaussian risk distribution toward a more realistic risk markets assumptions model

We have met recently a fund manager based in France, with a promising investment model aimed at generating an ambitious 8% of return in Euro, along with a volatility of 8%, hence to achieve a Sharpe ratio of 1.0 . We believe two distinctive features makes this fund to stand apart from its peer; a focus to control extreme risks (loss), and the use of big data and AI to evolve from the traditional Gaussian risk distribution toward a more realistic risk markets assumptions model.

The portfolio is invested in futures in equity, bonds or volatility to capture risk premia and yields. The management team is a compelling combination of high profile PhDs composing the R&D team, and seasoned portfolio managers. They have accumulated more than 10 years experience in fundamental research and have developed over 5 years proprietary academic and empiric research on behavioural finance, AI, and asset allocation covariance estimates. What we find interesting is that there is an ongoing interaction between the latest academic finding and empiric experience that feeds into the portfolio through robust implementation tools.

The basis of the investment philosophy is to approach investments with realistic markets behaviour hypothesis, capture risk premia and returns only when risks and correlation have a certain degree of certainty, and most importantly to disengage from the markets to keep portfolio risks under control or whenever risk premia are not adequately remunerated. This is achieved by taking a non-parametric approach, voiding market hypothesis, and applying an adaptive model using machine learning. Therefore, the portfolio is deemed to perform in most market environments.

Portfolio construction

Portfolio invests using quantitative and systematic strategies. It is made of 3 independent buckets of investments; stocks, bonds (govies), and volatility, which trade globally on liquid and electronic markets. Each bucket is allocated an equal risk budget of a 1/3 of the total risk budget that is set at 8% volatility.

The portfolio is made of between 15 to 20 positions in futures. As such the portfolio can be assimilated to a CTA strategy, but risk approach and trading pattern are different, as well as correlation to CTA remains low.

Performance

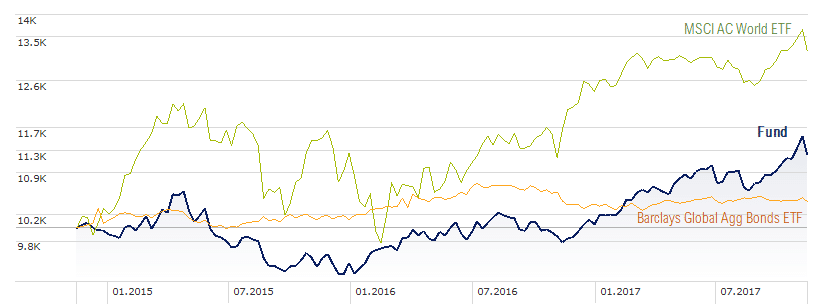

Outperformance adjusted from risk should result from the robustness of the model in period of market stress by reducing exposure to market risk factors. While we are lacking of such stress periods to fully assess the benefit of that portfolio’s approach, we can notice that in October 2016 and June 2017, the model cut the exposure to the fixed income markets, allowing to mitigate drawdowns.

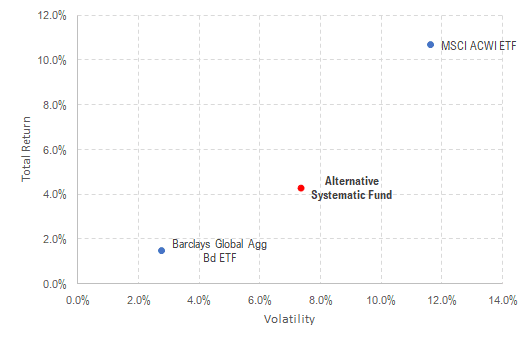

The standard three years period performance analysis shows a risk-return profile (in Euro) that stands between the global fixed income market and the global equity market as measured by the Barclays Global Aggregate Index and the MSCI AC World Index respectively (chart 1 below).

Chart 1: Risk Return Chart over 3 years in Euro

Source: Morningstar Direct, as per 31.10.2017

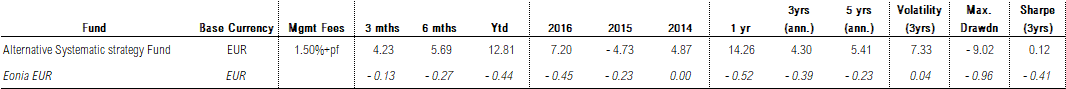

Over that 3 years period, the fund has evolved pretty in line with the global equity markets with a correlation of 0.56. The portfolio has maintained a volatility of 7.6%, slightly below its target volatility of 8%, however the relatively low performance recorded for the period (see performance table below) resulted into a weak Sharpe ratio of 0.12, still far from the 1.0 target.

Chart 2: Trailing Performance over 3 years in Euro

Source: Morningstar Direct, as per 31.10.2017

Performance Data Table

Performance data source: Morningstar Direct. Key Points provided by Wealth Solutions Partners SA – as per 30.10.2017 –

Past performance should not be seen as an indication of future performance.

A short bias over the long run on volatility

In conclusion, we are interested in this fund based on its recent performance that has been in line with its objectives, delivering a double-digit annual return in a bull market. We are just missing confirmation that the recent improvements will sustain the next period of market regime changes. This fund is efficient in trendy bullish markets and delivers good performances in bearish ones, according to the portfolio manager. It has a short bias on the long run on volatility, and can switch long over brief periods of time, if required by models. The low volatility regime prevailing since a while in most markets makes it difficult for us to test those assumptions. Hence, we have added this fund in our watch list and will start a due diligence.