Recently we have visited an asset manager based in London with a noteworthy profile. Indeed, it has a service offering pretty similar to what can be found at small-mid size private bank in Switzerland. They manage portfolios either directly, or through mutual funds for their clients, which open an account directly with them instead of maintaining it in a bank. They offer a mixed asset portfolio profile with a very conservative investment approach and a long-term investment horizon that can be tailored to client’s needs in certain circumstances. At first sight, it seems odd that we show interest for such managers while we are based in the city having some of the oldest and most prestigious private banks deemed to master the art of managing conservatively multi assets portfolios for their wealthy clients. However, what we have found interesting here is a boutique asset manager established since the mid 90’s having succeeded where many private banks often failed, say in delivering a robust long term compounded return while truly escaping the drawdowns that many claim to avoid without having necessarily done so.

In 2000, they set up a fund to offer this approach to UK-based investors in a pooled structure. Since then, their fund offering has evolved delivering their core approach in a regulated, open-ended UCITS format.

Currently the company manages over GBP 21bn of assets with a staff of more than 200.

Unaltered Investment Philosophy

Their investment philosophy and approach have been unchanged since the firm started.

They define themselves as absolute-return managers, with cash as the true benchmark given that cash provides no hazarding of capital, and no fee to be paid (at least in theory).

Considering this, they have two investment objectives:

- not to lose money in any rolling twelve-month period

- to grow funds at a higher rate than would be achieved by depositing them in cash

They believe, if they can achieve these objectives over the medium term, they should create wealth for their clients.

In addition, they target lower volatility and risk than a portfolio mostly invested in equities.

Investment Principles

To succeed in their objectives, they believe two principles are central to achieve absolute-return investing

- not to be dependent on the direction of markets

- to remove market timing from the portfolio

Again, while those principles seem obvious, the secret sauce resides in the execution. In that case, it has always been consistent over the long life of the strategy paved by financial market crisis.

Secret Sauce

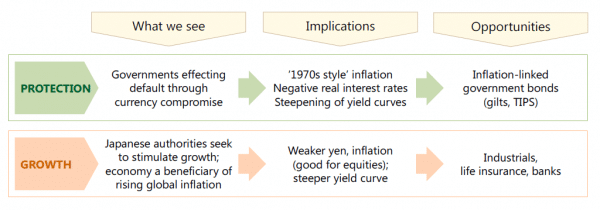

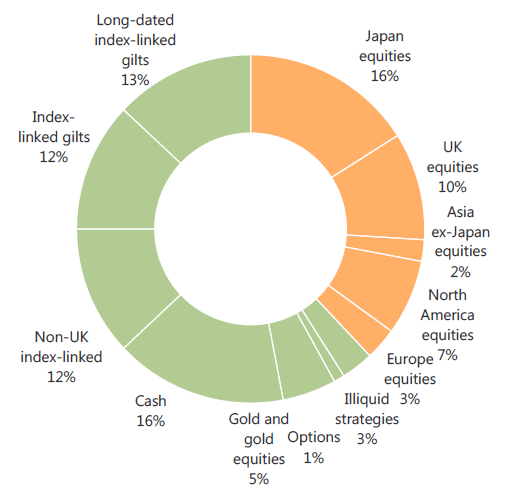

To avoid being dependent on the direction of markets, they seek to create a balance of offsetting investments. They always hold ‘growth’ and ‘protective’ assets alongside each other, varying the allocation to each over time.

The investments in growth are principally equities; the investments in protection are usually a combination of conventional and inflation-linked bonds, currencies, commodities and derivatives.

The protective assets should perform well in a downturn and defend the capital value; those in growth should deliver good returns in favourable market conditions.

They attempt to remove the need for market timing by always maintaining a balance of offsetting investments in protection and growth.

They are truly benchmark agnostic, staying focused on absolute return objectives. They have a forward-looking approach to target returns, assessing current and future risks along with prospective returns.

Investment Process

The investment strategy and asset allocation is a top down driven process including the CIO, the Chairman and the Head of research, taking decision based on the input from their senior portfolio managers and in-house research team.

The asset allocation is based on the prevailing risks and opportunities seen in the financial markets, identifying those asset classes that should benefit from an occurrence of the risk events (protective assets), or those presenting the best opportunities for growth globally (growth assets).

Stock selection follow a classical process by a research team identifying the best investment opportunities through valuation, growth situations, or restructuration.

Positioning – Protection and Growth

Source: Fund management company

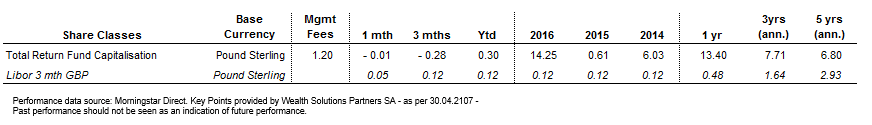

Fund characteristics & performance

Instruments |

Listed securities, collective investment schemes, derivatives for currency-hedged purpose, Inflation-linked Bonds, … |

Holding size

|

Equities: avg 1% to 2%, up to 5%, Fixed Income: higher than equities |

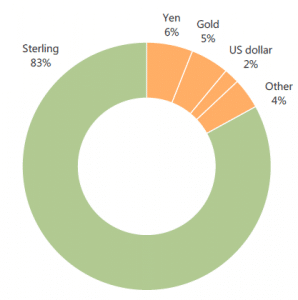

Reference Currency

|

Pound Sterling, all other share classes’ currency are hedged to pound sterling |

Asset Classes

|

Cash, equities and related, debt securities, commodities, currencies |

Domicile |

Luxembourg, SICAV |

Calendar returns (%), composite, net of fees

As 31 March 2017, the fund performance has been of -0.28% over 3 months in Pound Sterling, and flat at 0% in Euro. It has been of +13.4% and + 11.7% over 12 months in Pound Sterling and Euro respectively.

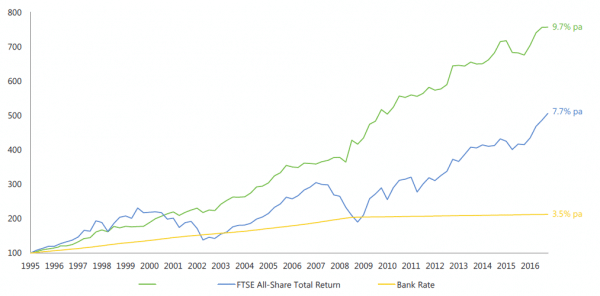

Since inception the strategy has generated attractive steady returns, including during difficult market conditions such as in 2000, 2003, and 2007 to 2009.

There have been 6 occurences over 21 years where the strategy did not meet its 12 month rolling positive performance:

- 31 dec 99: -0.2%

- 31 March 03: -0.8%

- 30 Sept 08: -0.3%

- 31 Dec 15: -0.1%

- 31 Mar 16: -5.5%

- 30 Jun 16: -1.9%,

of which, only two with a negative performance larger than -1%.

Annualised returns (%), composite, net of fees, cumulative from 30.6.1995 to 31.3.2017, in Pound Sterling

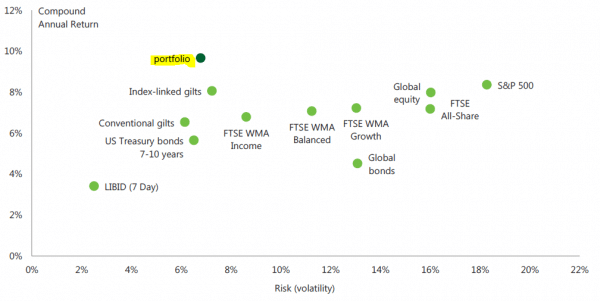

As shown below, over the long term the strategy has delivered its performance with lower volatility and low correlation to traditional asset classes.

Performance and volatility compared with indices, 21 years, annual returns to 31.12.2016

Source: Fund management company

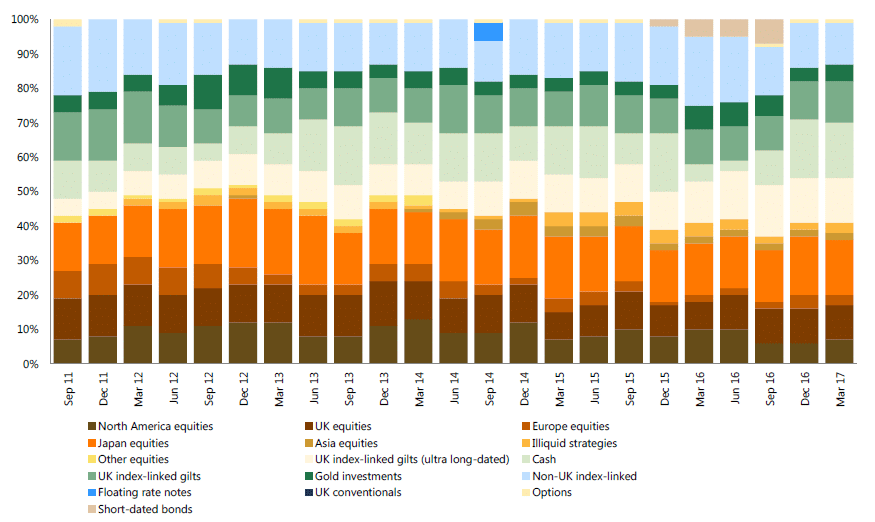

What is interesting here is that the attractive performance has been achieved with an uncommon allocation to traditional asset classes, and that the allocation remained pretty stable over time reflecting the choices made at the macro level were keys to success.

Fund asset allocation, as per 31.3. 2017

Historical Asset Allocation

Source: Fund management company

Conclusion

In conclusion, we are looking to add this strategy into our watch list to follow and analyse it against other multi-asset funds we already follow. Such strategy should be suitable for advisors looking for a robust portfolio for conservative investors familiar with private banks’ propositions. We find the risk adjusted return attractive on a long term basis compare to its peers.