The well-documented research of traditional factor investing is now extending to the alternative long/short risk premia. There is a growing interest among sophisticated investors to access liquid, low volatility, absolute return strategies and uncorrelated with traditional asset classes.

Hedge funds have been pioneers in this area, but the first alternative premia funds were only launched in 2013. There is a key challenge in developing an investable efficient low-cost proxy for harvesting alternative risk premia in a daily UCITs format. Most of the strategies launched recently have delivered modest returns on average, often disappointing in the downside due to their implicit correlation with risky assets.

Uncorrelated

The success of alternative premia funds depends mainly on their ability to combine true uncorrelated strategies in order to maximize the Sharpe Ratio. Re-correlation is often the main risk to those strategies as it occurs at the worst possible time when risk aversion is increasing and risky assets slump. History provides some examples such as the “quant crisis” of August 2007 or exposure to the same idiosyncratic risk such as the Swiss Franc appreciation in January 2015. A sound analysis of those circumstances is key to achieve a good mitigation of the risk and strong risk-adjusted returns.

Resources

Alternative premia strategies need human resources and infrastructure to succeed. We found an Alternative UCITs fund with daily liquidity and more than 3 years of consistent track record. The strategy is a multi-asset market neutral fund which aims to capture uncorrelated risk premia across three families: academic premia (through plain vanilla instruments), implied premia (mainly volatility with derivatives) and carry on liquid premia across the full range of assets. The investment universe comprises equities, commodities, FX, credit, interest rates and volatility. Each position in the fund is executed with a relative value approach and a there is a great emphasis in the process to minimize correlation with traditional asset classes and with strategies amongst each other.

Volatility Budget

Premia are selected through quantitative filters and dynamically allocated to achieve a stable portfolio diversified across several premia. The allocation process relies on an equal risk contribution with a discretionary overlay for tactical positioning, but overall the Investment Team tends to remain conservative in its volatility budget. The fund’s volatility target is 7% but historically it remains close to 5% with a Sharpe Ratio of 1,5.

The Portfolio Managers are all experienced specialists in their fields, with complementary backgrounds in derivatives and in quantitative asset management.

The fund is highly diversified with no directional bias, it exhibits a robust absolute return track record and above average risk-adjusted profile. The fund is a valuable proposition to replace traditional bond strategies or risk parity allocations. The fund has been added to our Watch List for further research.

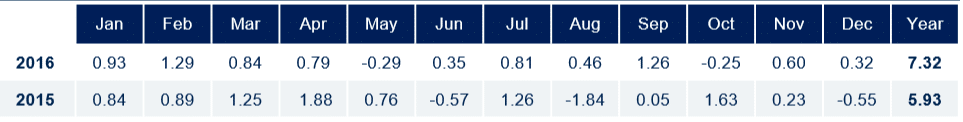

Fund monthly performance – last 2 years