We recently received many visits of asset managers presenting Senior Secured Loans strategies. The asset under management of Loan funds are constantly growing, showing the investors strong appetite for fixed income products without duration sensitivity and still offering an attractive carry. Within the asset class, we are particularly interested by a strategy managed by a small asset manager based in Europe. Apart from the performance, it is cumulating the criteria which are, in our view, amongst the most important in managing Loan funds: the experience of the Portfolio Manager, a proven credit culture of the asset management company, a still reasonable AUMs size (less than EUR 500mn), and an adequate redemption clause (bi-monthly with 10-day notice period).

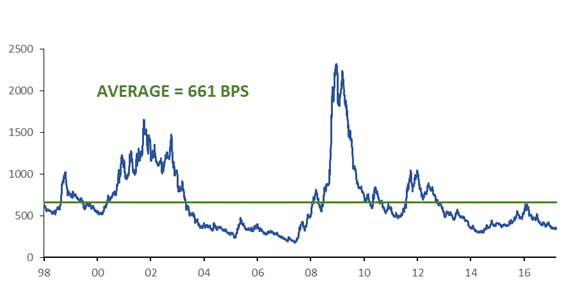

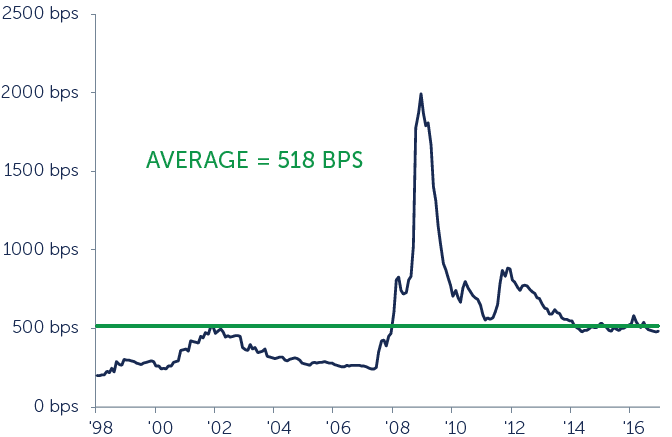

The Portfolio Manager is in charge of two strategies: a pure European Loan strategy and a mix of European Loans and High Yield bonds. In the mixed strategy, the Portfolio Manager is clearly favouring loans. They are yielding 4,9%, compared to BB rated European companies yielding 2,5% and B rated corporates 5,5%. On a historical basis traditional bonds are currently trading well below their long-term average spread, while Loans are hovering near their average spread level.

Euro HY Option-Adjusted Spread

European Loan Spread

Source: Credit Suisse European Leveraged Loan Index

The performance of the fund in 2016 was slightly disappointing compare to its main competitors. The fund was too defensively positioned, particularly at the beginning of the year but it didn’t experience any credit events. Although the Portfolio Manager recognizes to have been too conservative in 2016, the performance over the long term remains very solid and we are closely considering to add this fund on our master list. With only 2.6% volatility the fund exhibits a sharpe ratio of 2,3, difficult to beat in the current European Credit universe.

While bond spreads in Europe are at record tight level for almost every rating categories we think that Loans, by being excluded from the asset purchase program from the ECB, exhibit currently the best return/profile within the credit space. Although, the European Loan market grew remarkably since 2008 and has become much more liquid, we think that most of the Wealth Managers are still under-exposed to this asset class. While keeping in mind that Loan remains a flow-driven market which can experience drawdowns as severe as the High Yield market during liquidity crunch, we believe it represents an attractive alternative to short-duration High Yield strategies that we see proliferating for some years. We are therefore considering Loans as an asset class per se with at least 3 different asset managers present in our master list.