In the universe of Alternative UCITS funds, we have met the managers of an absolute return strategy investing in the options market to generate steady returns. The strategy is structured to generate returns uncorrelated to the underlying equity market regime. By construction the portfolio is long and short volatility at the same time, allowing it to stay market neutral. Portfolio managers have organised the portfolio with the objective to generate profit during normal (up/down/flat) markets while protecting against market crash, and to capture returns from a wide range of market outcome. Currently, the portfolio has three buckets of strategies; Range-bound spread, directional spreads, and Hedging positions.

Range-Bound spread positions:

- designed to generate returns in normal up, down or flat markets

- These positions have contributed two-thirds of the portfolio’s alpha since inception

Directional Spread positions:

- Act as portfolio diversifiers, with the ability to add incremental gains when markets have extreme behaviour

- Have contributed one-third of the portfolio’s alpha since inception

Hedging positions

- Puts are laddered for various market outcomes to the downside

- Designed for tail risk protection

We like the transparency and liquidity of the strategies, as well as the stable returns recorded since 2008 (the US domiciled fund). The UCITS version have been launched in 3Q 2016, therefore it is still too early to ascertain if this new fund’s performance will fully replicate the US version.

Over the past three years, we have noticed the strategy has recorded positive albeit diminishing rate of returns. We are interested to understand the reasons of that decline. More specifically if it may originate from the information advantage the fund managers are exploiting in the option market is not slowly arbitraged away. This fund has been included in our watch list.

Key fund characteristics

Instruments |

Listed options on S&P 500 in combination with passive S&P 500 index exposure |

Option duration |

20 to 75 days |

Number of options |

40 to 100 individual options |

Collateral utilization |

20% |

Budgeted cost of hedging positions |

50 bps |

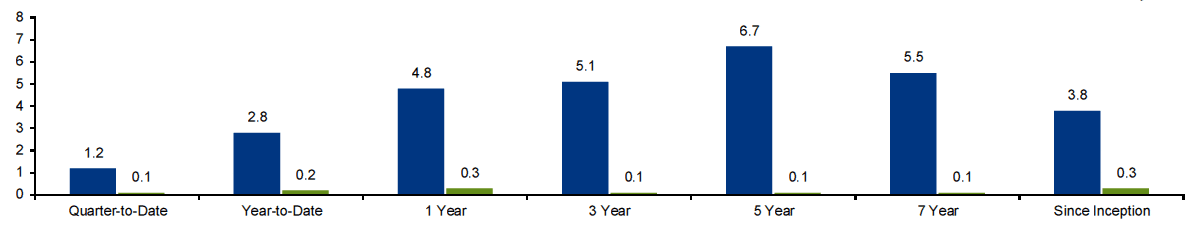

Annualised returns (%), composite, net of fees

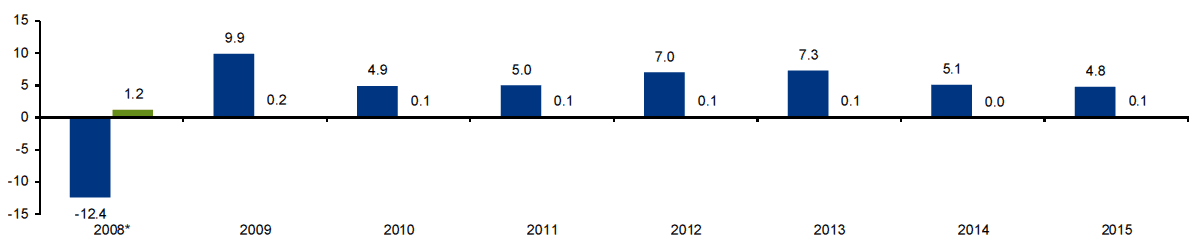

Calendar returns (%), composite, net of fees