Investors having the Swiss Franc as a based currency are struggling to find positive yields in the domestic bond market. The safest bonds in the Swiss market have negative yields up to 15 years of maturity.

In this context, we have been attracted by a fund portfolio investing into the CHF bond market with a target return of 5% above the short term rate while maintaining a low volatility budget.

The fund launched in January 2016, has now slightly over more than 1 year of life and has close to CHF 300 mio of AUMs. It offers a weekly subscription and monthly redemption (+ 1 mth notice period) liquidity to investors.

The return objective is CHF 3m libor + 5% with a volatility of 4-7%. It is a rather ambitious objective in the current market condition, but undoubtedly attractive if realised as promised.

The portfolio is managed by a specialised team based in Switzerland. The strategy peculiarity is to exploit opportunities in every segment of the CHF fixed income market to generate return. Hence, it could benefit from negative yields combined with market price inefficiencies to generate positive performance.

To that aim portfolio managers are using three distinct strategies:

Long/short

- To obtain a return symmetry independent from market condition.

Convergence

- To exploit structural inefficiencies in pricing formation in the Swiss Franc bond market compare to the international markets.

- Otherwise said, the fund managers implement opportunistically pair trades between CHF cash bonds and CDS in EUR or USD for same issuer.

Liquidity Premium

- To capture bid/offer spreads by being a liquidity provider.

- More simply, portfolio managers act as market makers in the CHF bond market.

The portfolio managers generate returns in excess to the current available yield by leveraging the access they benefit from the large financial institution they are part of to the CHF fixed income markets, including to the exclusive Repos market. It makes a unique feature for this fund able to deliver returns in excess of 4% in the CHF denominated bond market.

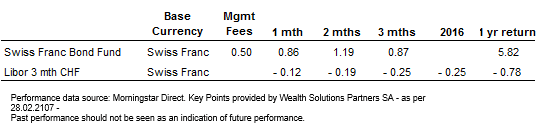

The one year performance has been strong at close to +6%.

This fund is aimed at qualified investors and for portfolio diversification purpose. It can bring further diversification to a large CHF fixed income portfolio.

Other specific risks we still need to assess as part of our due diligence

- Level of expertise and achievements from the portfolio managers’ team.

It is critical to assess the experience of the portfolio managers in mastering the markets they operate. It is a key element to achieve persistency of returns in a controlled risk framework. - Stickiness of the team (key man risk). A high turnover in the team can be disruptive to a strategy requiring very specific skill sets.

- Risk controls robustness, purpose and independence must be of high standard in consideration of the instruments used in the fund.

From the current level of information we have on the fund, we are confident the above requirements should be fulfilled.

What we liked the least : Performance fees of 15%

We have decided to introduce this fund in our Watch list. A full due diligence is planned to fully address the above mentioned points and complete our assessment process before considering it for the master list.

Key fund characteristics

Instruments |

Cash Bonds, Interest rates and Credit derivatives, Repos (standard GMRA) |

Average Credit Rating

|

BBB+ |

Volatility since inception (ann.)

|

1.5% |

Legal Structure

|

Q-QIF Scheme |

Eligible Investors

|

QI according to the Swiss Law (CISA) |

Returns (%), net of fees