We are starting the coverage on a US dividend strategy that did not yet reached the three years’ track record since inception but with impressive relative performance.

The fund exhibits one of the best risk-reward profile in the US Large Cap universe. The Portfolio Manager is highly experienced in US dividend investing. He has an established investment process and managed US high income funds with a similar investment philosophy since 2007.

The fund aims to invest with a bottom-up approach in undervalued North American equities (including Canadian names) with a sustainable dividend yield above 2% and that is at least 1% higher than the market at any time. Holdings are systematically sold whenever their dividend yields fall below 1.5%.

Stock research is valuation-driven using DCF models to determine target prices that are reassessed after each quarterly report.

The process also focuses on quality of management. The lead Portfolio Manager meets the top management of each company to assess the capital allocation policy. The aim is to ensure that there is a low probability of dividend cut and ideally a dividend growing in a consistent trend annually.

The portfolio is well diversified around 40-60 stocks, typical stock weight is between 1% and 3%. On average the turnover stands at 30%-60% but in 2016 it has been higher due to large inflows in the strategy. Active share is typically above 80% reflecting the bottom-up high conviction portfolio construction.

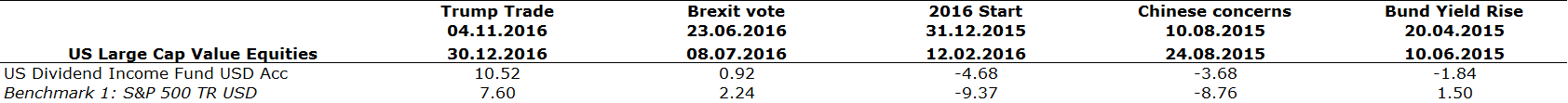

The fund significantly outperformed in each extremes scenario since inception (August 2015, the start of 2016 and the Brexit vote). Since inception, the fund captured 98% of upside participation for only a 64% down market capture ratio (as of 28.02.2017) and it ranks in the top decile for risk-adjusted-returns.

We acknowledge the scarcity of resources among the team, with only 2 investment professionals, however the high-performance culture of the boutique ensures that the lower breadth in stock research is well-compensated by in-depth fundamental analysis.

The fund provides one of the lowest correlations to other US equity funds due to its wider opportunity set. Canada provides great opportunities for dividend style stock picking, expanding the scope for alpha generation and it acts as a good diversification tool.

The strategy is nimble, with a consistent contrarian and fundamental approach. We like the nice level of income stream of the fund that has been consistently achieved since inception.

Resilience in stressed period

Source: Morningstar, Fund management company

Past performance does not guarantee future results. You should not rely on any past performance as a guarantee of future investment performance.