Wishing you a happy and prosperous New Year on behalf of the WS Partners team.

We look forward to partner with you in 2018.

We had a year 2017 full of challenges, yet strong achievements.

For 2018 we expect a handful of promising ventures.

The year 2017 is closed, the occasion to look back on achievements, successes, but also frustrations in some instances. At Wealth Solutions Partners, we are proud to have accomplished our first calendar year of activity with good results.

The year started with the hope to sign our first contract with a sizeable Swiss private bank, namely the bank SYZ. The whole process was achieved at mid-year. It has been a great milestone for us, a strong recognition by the market of our ability to deliver the highest quality of services to demanding private banks in Switzerland.

At the beginning of the year we had also the chance to have Philippe Darbellay, formerly senior fund analyst at Pictet Wealth Management, to join the company. He is a strong addition to our team by bringing plenty of experience in portfolio management and fund selection.

During the year we continuously adjusted our services to answer the needs of our most demanding customers; the private banks, the independent wealth managers and the family offices from Switzerland and elsewhere.

We have spent time meeting, visiting, communicating with our vast network of fund managers, but also uncovering new talented active portfolio managers.

More than 300x, one-one meetings, attendance to conferences and seminars in Geneva, Switzerland, Europe and other parts of the World.

We have developed our fund selection Master List based on our clients’ needs, selecting the funds best matching our strict quantitative and qualitative criteria.

The potential to extend this list is great as we maintain a Watch list of funds likely candidates for inclusion in various asset classes.

WSP Master List has close to 100 funds, across 56 strategies in equity, fixed income and alternative asset classes, and is still growing

The watch list has already more than 80 funds we find of interest, either for the unique strategy, or the process they present.

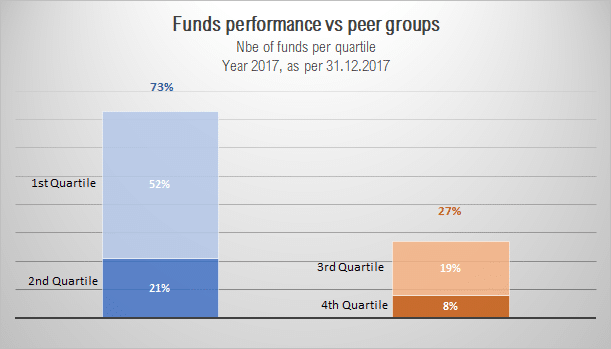

WSP Fund selection has achieved superior performance compared to peer group and benchmarks.

We are proud our selection has delivered strong alpha across the board during the year. 78% of our selection has beaten the benchmarks in 2017, and 73% outperformed the peer groups.

It proves that a careful selection process based on a deep expertise and long-time experience can spot active fund managers generating alpha ex-post.

Building a proprietary database that contains already more than 200 asset management companies we know their key expertise as well as assets exposure.

The universe of investment opportunities is vast and is growing fast, driven by the ongoing structural changes in financial markets. The number of investable sub-strategies has grown by at least a factor of 5 over the last 10 years. It has created a challenge for fund selectors as us, to compare a fund’s relative performance versus its peers, or to select a fund manager focused in a very particular strategy. We have addressed this challenge by developing our proprietary database to be able to profile and accurately identify asset managers based on their specific expertise.

WSP Model Portfolios made of active funds have delivered robust alpha

We have launched our model portfolios at inception of the company, in 2016. Hence, at the end of 2017 we have 18 months of performance record.

All of them have reached their targets by creating alpha ranging from 0bp up to +308bps. Furthermore, this alpha was delivered with less risk, as measured by volatility, than the reference passive portfolios.

Full results and comments can be seen in the December Performance Report published in our web site’s News page.

Research, articles and views

In our continuous commitment to furthering our skills and abilities to succeed in a highly competitive and ever-changing marketplace, we have researched during the year on topics linked to fund selection, ranging from the low volatility investing to the peer group creation problem.

8 articles on fund selection and fund portfolio management research,

19 funds’ strategy reviews published.

Available in our web site’s News page.

Highly promising engagement with prospects & customers

We have continued to develop relationship with prospective customers; meetings private banks, independent wealth managers and family offices in Geneva, Switzerland, and in few instances with prospects in Europe and in the Middle-east. We spent time explaining our value proposition in details.

The B2B asset management services for wealth management remains a brand-new value proposition for many, needing time and education before adoption.

We have developed enriching relations leading to highly promising partnerships.

We engaged with many of our new customers to deliver tailored solutions in fund portfolio monitoring and risk management, in enhancing their selection process, as well as helping them to match compliance requirements. It translated into decisive improvements in many aspects of their financial services offering, a true game changer, a true source of new business generation.

Outlook 2018

Entering into 2018, we have exciting projects centred around delivering further value-added services to you.

In 2018, portfolio management will require caution and insight due to stretched valuation and signs of investors complacency.

Support your changes

Most importantly, we want to position Wealth Solutions Partners as the partner of choice for banks and independant wealth managers to migrate successfully their business into the framework of Mifid II and subsequently the LSFin in Switzerland. Both will trigger many changes in the way many of you do wealth management, including to explore the use of outsourcing for tasks linked to investments.

New investment opportunities

Regarding fund selection, we will continue to leverage our partnerships with research platforms to cover long-only, alternative UCITS, Smart betas, ETFs and last, but not least, extend in the SRI strategies. Along with our proprietary database of asset managers, we will monitor new entrants in the asset management industry, focusing on niche asset classes of value not yet covered by you.

Fintech

In our goal to consistently improve our analytical skills, we want to build tools using a combination of AI and big data to leverage our knowledge. We will also follow closely on the development of blockchain technology to understand and to benefit from the changes it may have on our industry. We will focus our research on the value and risks of new financial instruments such as the cryptocurrencies.

Access-free WSP services

We will connect further with the Independent Wealth Managers and the family offices by creating a unique fund selection platform fully dedicated and access-free to them.

Private Banks servicing

With private banks we will follow closely on their business repositioning, staying ready to deploy tailored services.

Commitment

We reiterate here again that we would like to bring to the Swiss investment professionals and private banks community our deep knowledge and extensive experience in delivering cost effective fund selection and advisory services, bringing value added solutions in an open architecture model.

In the current complex world, investment professionals will seek more and more to establish partnerships with focused, knowledgeable, well experienced specialists able to understand and connect them to the world’s best solutions to grow their business successfully. We want to be one of those partners delivering with quality and consistency.