[private]

Globally, health care stocks declined as part of a broad equity market sell-off during the last quarter, but with high dispersion within different sub-industries. On a sub-sector basis, health care technology, supplies and services firms underperformed as valuations for some of these companies had become inflated earlier in the year 2018. Although no sub-sectors delivered positive returns, pharmaceuticals and managed care companies suffered smaller losses.

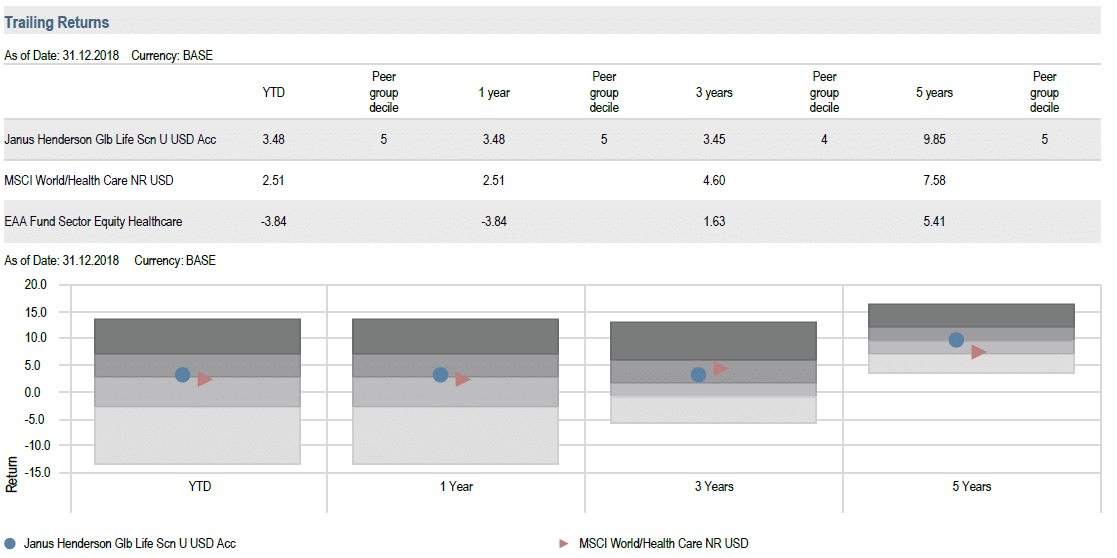

However, the MSCI World/Healthcare Index NR in USD was the best performing sector during 2018 (+2.5%). Last year, only 22% of the funds within the Morningstar Sector Equity Healthcare peer-group outperformed the benchmark and the fund Janus Henderson Global Life Sciences is one of them. This fund has been added in our selection in March 2018.

Hereafter we explain the calendar performance of the fund, with a focus on Q4 2018 and we detail the outlook of the investment team.

Performance review

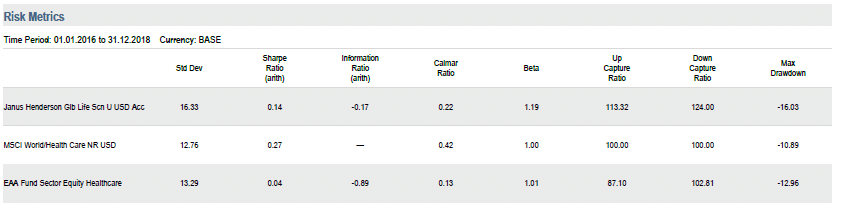

Although outperforming modestly its benchmark in 2018 (+3.5% versus +2.5% – IE00BFRSYJ83 clean fees share class in USD), the fund ranked in the 3rd decile of its peer-group in 2018. The 4th quarter of last year was more disappointing, the fund underperforming its index by 4% (-13.4% versus -9.4%) mainly impacted by its structural overweight in biotech names, that experienced a severe sell-off, an underweight in pharmaceuticals that again proved to be more defensive. Stock selection in both sub-sectors detracted the most from relative performance during the quarter. Aiding returns were the fund’s holdings in health care equipment and life sciences tools and services.

The overweight in small and mid-caps stocks was also a drag to relative performance. As of 31.12.2018, among the 96 holdings, 49 names are below USD 5Bn market capitalization and most of stocks in this tail portfolio were negative contributors during the last quarter.

On an absolute basis, Neurocrine Biosciences was the largest detractor during Q4 2018 (-100 bps). The stock declined when lead drug Ingrezza failed to meet the primary endpoint in a phase 3 trial for Tourette syndrome Since the drug launched, uptake of Ingrezza has exceeded estimates, and Portfolio Managers (PMs) believe the market for the therapy remains underpenetrated. In addition, Neurocrine’s partner recently launched Orlissa, an oral medicine to treat pain caused by endometriosis, which has blockbuster potential.

Anaptysbio also weighed on performance (-55 bps), this development-stage biotech company was largely caught up in the sell-off of small cap biotechs during the period. However, PMs continue to like the stock. Its antibody discovery platform has produced two leading drug candidates (Etokimab and ANB019). PMs believe both drugs, if successful in late-stage trials, could have blockbuster potential. Lastly, AnaptysBio’s antibody discovery platform has resulted in out-licensing deals, which could result in significant royalties for AnaptysBio.

Teladoc Health had a negative contribution of -50 bps during the Q4 2018. After rising through much of 2018, the stock declined during the period as many high-growth, tech-related stocks came under pressure. In addition, the stock suffered from allegations that Teladoc’s CFO and another employee had an improper relationship and traded company stock together. Subsequently, the CFO resigned. While disappointed by these events, PMs still are optimistic about Teladoc’s long-term outlook. The company is the largest telehealth platform in the U.S. and continues to benefit from the health care system’s focus on improving costs and efficiencies. PMs also think it is differentiated by its scale (Teladoc has 75% market share), brand, relationships (the company has access to millions of patients through major health care providers), technology infrastructure and patient engagement strategies which should be supportive for the firm’s growth.

On the other hand, the fund benefitted from other holdings, including Merck & Co., the top contributor over the quarter (+31 bps). The pharmaceutical company is benefiting from the rapid sales growth of Keytruda, a leading checkpoint inhibitor for the treatment of certain cancers, including melanoma and non-small-cell lung cancer. PMs believe Merck is well positioned to expand Keytruda for other indications in the near future. They also like the management team, which has executed clinical trials well.

Another pharmaceutical company, Eli Lilly & Co., was also a top contributor (+23 bps). The stock climbed, benefiting from several recent drug launches, including Trulicity, Jardiance, Taltz, Olumiant, and Emgality. PMs anticipate that these products will help drive sales growth and lead to significant margin expansion for the company.

Outlook

Market volatility and regulatory uncertainty weighed on health care stocks at the end of the year. In mid- December, for example, a U.S. federal judge ruled the ACA unconstitutional, which could jeopardize health care coverage for millions of Americans. However, the headline may seem direr than reality. For one, the decision faces an appeals process that could go to the Supreme Court, which has already upheld the ACA twice. Second, Democrats, who take control of the House of Representatives in January, have announced their commitment to defend the law. Finally, Republicans may be reluctant to see millions of constituents potentially lose their health care coverage in the lead-up to the 2020 presidential election.

PMs are monitoring these developments closely, but they believe the sector continues to have significant long-term growth drivers. In 2018, the FDA approved 59 new therapies, setting an all-time record for approvals in a year. Over the past two years, more than 100 new medicines have been approved. With branded drugs typically having a life cycle of a decade or longer, they believe these early launches could deliver years of growth for the sector.

Looking ahead, PMs believe innovation remains robust. The first gene therapy for spinal muscular atrophy – the leading genetic cause of infant death – could soon launch in the U.S. Progress also continues with immunotherapies, leading to significant survival benefits for patients with devastating forms of cancer. Finally, recent data indicate the potential for dramatic health improvements for patients using mitral valve heart repair devices and drug-eluting stents.

While the market volatility experienced at the end of 2018 could persist into 2019, they believe aging populations and innovative products should drive continued demand for medical products and services, making the health care sector attractive to investors. PMs also believe the recent market pullback offers opportunities to invest in high-quality companies that are developing therapies for unmet medical needs or improving efficiencies within the health care system. Many biotechnology stocks, for example, have been particularly hard-hit during the market rout, some of these companies are now attractively valued, potentially leading to another pickup in merger and acquisition activity within the group.

WSP Analyst Conclusions

Despite the underperformance in Q4 2018, we confirm Janus Henderson Global Life Sciences fund as our best choice in the Sector Healthcare Equity peer-group and we maintain this fund with the “Selected” status in our Lists.

L’équipe WSP [/private]