[private]

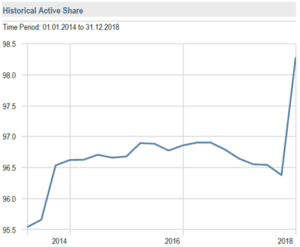

Global Value investors have been struggling for many years now to outperform both the MSCI World or the MSCI ACWI indices. Despite being challenging times, not only for global value funds but also regional value strategies, we have selected the Investec Global Value Equity within our Master list for investors who want to diversify their portfolios out of momentum and quality growth strategies.

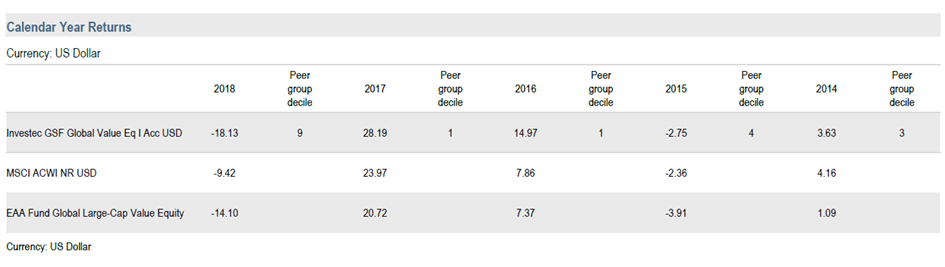

2018 has been a very difficult year for actively managed funds and alpha generation as a whole. Value was a detrimental bias and the Investec Global Value Equity fund was not immune. The fund significantly underperformed its benchmark, i.e the MSCI ACWI NR USD Index in 2018: -18.1% versus -9.4% for the index. More disappointing, the fund also underperformed a Global Value benchmark.

Hereafter we explain the calendar performance, with a focus on Q4 2018 and we detail the portfolio activity.

Performance review

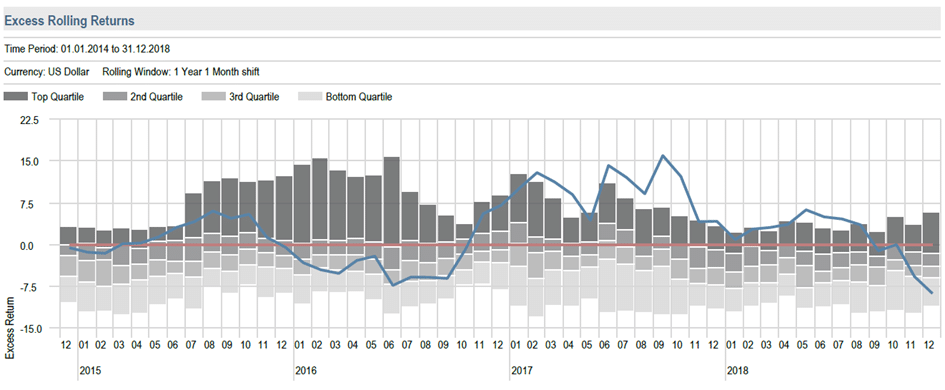

2018 is by far the worst calendar year since 2008 for the strategy both on absolute and relative basis. Since lead Portfolio Managers (PMs) Steve Wolley and Alessandro Corradi took over the fund in January 2016, it has been the most disappointing underperformance. 2018 has been a year of two halves. Until end of September 2018, the fund was barely in line with its benchmark, which was satisfactory for a value strategy. Q4 2018 was a more painful period, contributing almost entirely to the whole underperformance of the year.

For the past quarter, most of the lag was derived from stock picking; sector and country allocations being respectively flat and slightly positive. The overweight exposure to Brazil through three utilities companies were among the most rewarding investments during the quarter as they rallied by 30-50% on the back of a presidential election won by Bolsonaro, the business-friendly candidate.

Stock selection has been particularly detrimental in off-benchmark names, and in the US. For the latter, it was partially offset by not holding some IT stocks, which slumped during the quarter, such as Apple, Amazon, Facebook or NVIDIA. Not being invested in some energy index incumbents such as Exxon or Schlumberger was also positive. In total those underweights added +100 bps.

On the flipside, five names detracted each more than 80 bps from relative performance over the quarter for a total of -520 bps: Conduent, Welbilt, Signet Jewelers, Adient and Delphi Technologies (all are not included in the benchmark).

The first two stocks in that list, Conduent ( IT outsourcer) and Welbilt (supplier of professional kitchen equipment) are two businesses whose industries PMs consider to be both predictable and not particularly cyclical, and whose valuations are considered cheap. Each issued relatively minor profit warnings early in November 2018, but their stocks dropped over 30% in a matter of days. These moves are hard to relate to the fundamentals of the businesses, or to the content of the announcements. Next down the list, Signet Jewelers (a turnaround story) actually guided up slightly in its latest earnings report, but the stock fell 20% on the day and a further 10% in the subsequent week. The conclusion seems to be that investors were extremely nervous and reacting very badly to anything but perfect news.

Lastly, the two auto parts suppliers, Adient and Delphi Technologies, which make, respectively, seats and propulsion systems (for internal combustion, hybrid and electric vehicles). PMs bought into these stocks after they had severely underperformed and were already trading extremely cheap, but they continued to slump even after the purchase. The auto parts sector is currently being priced as if the industry is going to go out of business in the next five years, and PMs are very happy to take an opposing position to this view.

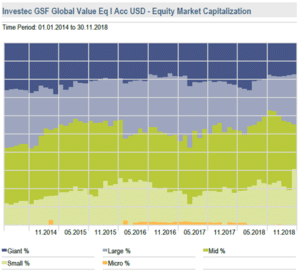

In addition to the above, the fund retains a structural overweight in small and mid-caps, historical average is around 50%, which was particularly detrimental to relative performance over the quarter given a sharp sell-off in that segment.

Source: WS Partners- Morningstar

Portfolio activity

With so many stocks and sectors selling off in the latest quarter, the investment team found plenty of opportunities to add to existing holdings at lower valuations or to initiate new positions altogether. They added to their holdings of Cielo (Brazilian merchant acquirer), SKF (Swedish ball bearing manufacturer), Travis Perkins (UK builders’ merchant), Adient (car seat manufacturer), Barclays and Lloyds Bank.

They initiated new positions in Delphi Technologies (supplier of vehicle propulsion systems), Western Union (provider of cross-border remittance services), Kangwon Land (South Korean casino operator), McKesson (US pharmaceutical distributor) and Adecco (provider of temporary staffing services). They funded these purchases though a mixture of cash, and via selling their holdings in Microsoft and Centrica, as well as reducing the positions in Japan Airlines and Yara (Norwegian fertiliser producer).

WSP Analyst Conclusions

In the current environment, it is not an easy task to be a contrarian value investor focused on identifying, through the cycle, cheap, out-of-favor companies. This requires, a solid fundamental skillset with patience and a long-term approach. Main challenges remain to avoid value traps and selectively identify attractive companies with irrational selling pressures, not linked to fundamentals, but with a recovery potential.

Since beginning of 2019, this strategy has paid off as the fund recovered partly from its underperformance of last year. As of 21.01.2019, the fund outperforms its benchmark by 4.7% as of 23.01.2019 (+10% for the clean fee share class in USD – LU0696274983 versus +5.3% for the MSCI ACWI NR USD Index).

In conclusion, we confirm Investec Global Value Equity fund as our best choice in the Global Value Equity peer-group. We think it is a sound diversifier within a global portfolio to balance exposure in quality growth strategies and smooth returns over a market cycle. Hence, we maintain this fund with the “Selected” status in our Master List.

L’équipe WSP [/private]