[private]

The fund is a core US equity which aims to outperform the S&P 500. The long/short (‘130/30’) structure allows manager Stephen Moore to take larger positions in his ‘best ideas’ in the US market, while maintaining a net market exposure of close to 100%. The strategy has a relatively strong macro overlay which will determine the net exposure and the sector allocation without having a structural style bias. Their proprietary macroeconomic and stock analysis underpins the PM stock selection.

The fund lagged what was a strong quarter for the US market. After the sharp sell-off in December the market rebounded sharply fuelled by the dovish message from the Fed and easing of the trade tensions between China and the US.

Performance review

YTD performance of the fund as of 30.04.2019 : 15.8% vs. 18.2%

The PM turned cautious in September 2018 which was reflected by a decrease of their cyclical exposures, an increase in the most stable business such as Healthcare, Utilities and in Defense companies. It was also reflected in their net exposure of around 89%. While this positioning helped the portfolio in Q4 2018, it has been a detracting factor in the first quarter of this year.

YTD detractor

- Net exposure averaged 88.6% over the quarter.

- Stock selection was positive but sector allocation impaired returns.

- Exposure to health insurers impaired returns as the sector suffered on the back of the Democrats advocating for a reform.

- Energy has also been a detractor, as they had an underweight in average of 2% vs S&P500 and 1 stock hurt (Marathon Petroleum)

- Within industrials, a short position in a large industrial company detracted as the stock rallied on positive news and their holding in Boeing suffered on the news of the crash. They decided to add to the position after the fall.

YTD contributor

- They added to technology names over the quarter and they now have an overweight position in the sector. They added their exposure in semi-conductor through Qualcomm. Overall the exposure to semis was positive as the group has started to perform again after a period of underperformance.

- The fund has benefited from its negative stance on financials: underweight in banks and a positive stance on diversified financials (MSCI amongst the top contributors).

It should be noted that the fund, has so far, a strong month-to-date performance, as expected in down market. It has recovered a large part of its YTD underperformance (-2.9% vs. -3.7% as of 14.05.2019).

The fund remains one of the very few US blend strategy to outperform the S&P500 in every time horizon beating the benchmark in 2015, 2017 and 2018. Versus its peers it is top decile for 3 years and since in absolute performance as well as in terms of performance adjusted. This performance has been done with a lower volatility (10.2 vs. 11.2 for the S&P 500 and 11.3 for the peer’s average). Finally, the up-/down market capture ration shows a strong and positive asymmetry 94/81.

Positioning

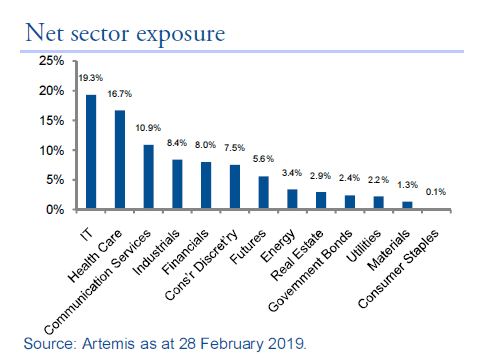

Overall the shape of the portfolio hasn’t changed much over the quarter. Net exposure remaining at around 88-89%. They have re-increased their exposure to technology notably through semis and remain underexposed to financials and staples. The overweight to healthcare has been reduced and they are underweight industrials.

Conclusion

Despite being negative in relative performance since the beginning of the year, we confirm Artemis US Extended Alpha with the “Selected” status.

- The fund has been lagging in Q1 2019 for the same reason which helped them to absorb some of the loss in Q4 2018.

- Over a longer time horizon, the fund is exhibiting the most consistent track record in the US large cap blend universe.

- In this unstable market environment, we may be inclined to favor funds with a low to neutral beta figure and showing a positive market participation asymmetry.

WSP Team [/private]