[private]

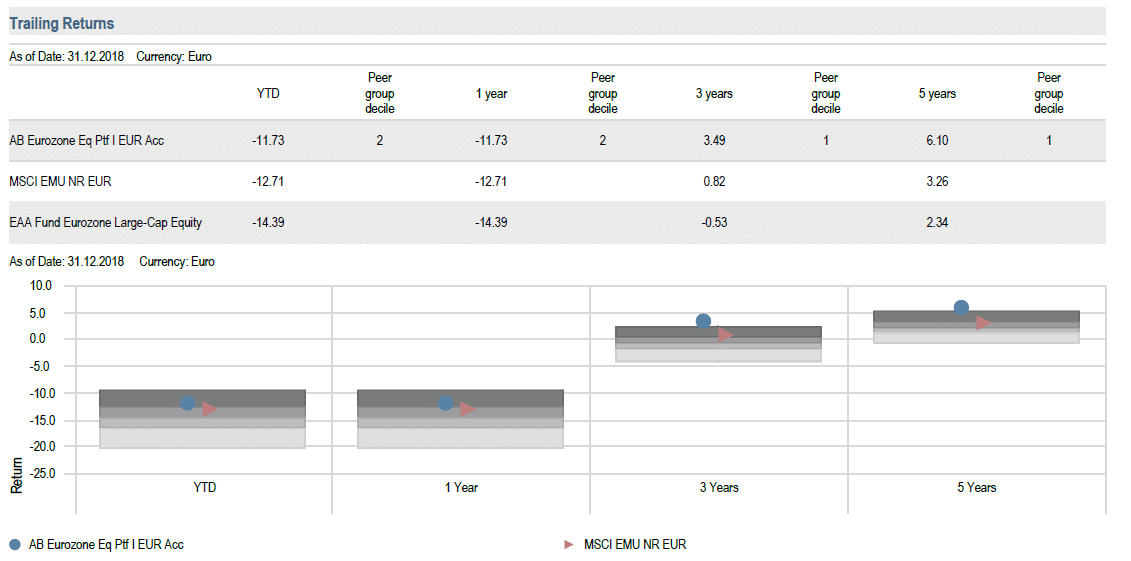

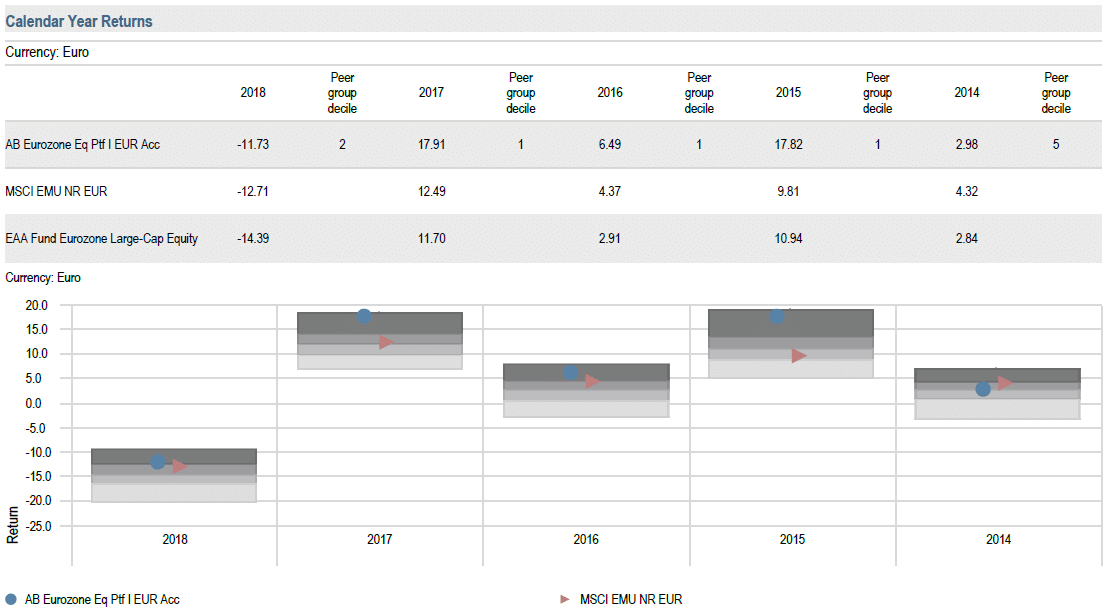

Concerns over a Brexit issue has led some investors to focus on Eurozone Equities in their portfolios, and we see increasing demand for those strategies. Since 2017, we have only one fund selected in that space, the Alliance Bernstein Eurozone Equity Portfolio. Despite a modest outperformance in 2018 (-11.7% versus -12.7% for the MSCI EMU NR EUR Index – clean fee share class I EUR LU0528103707), the fund has ranked in the 2nd decile last year. Given the scarce alpha generation within the Eurozone Large Cap peer group, relative performance for this value tilted strategy was satisfactory as growth style outperformed again, like in any other regions.

Hereafter we explain the calendar performance, with a focus on Q4 2018 and we detail the recent portfolio activity.

Performance review and activity

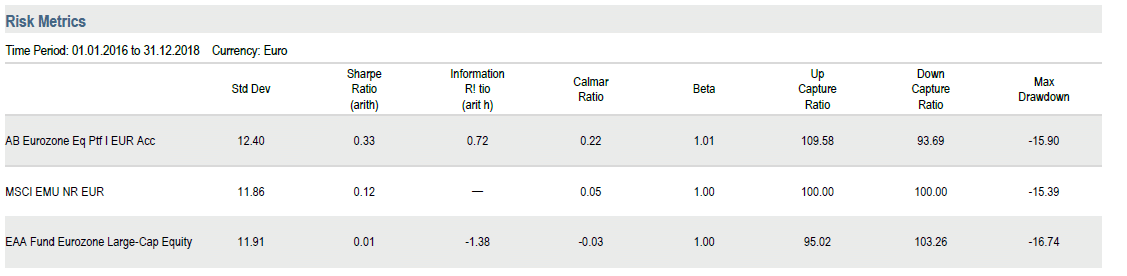

Since lead Portfolio Manager (PM) Tawhid Ali took over the fund in March 2008, the fund exhibited a very consistent track record, outperforming its benchmark and peer group in 8 calendar years in the last decade. 2018 was modest in alpha creation but as expected for this strategy it was mainly derived from stock picking.

The leading contributors in 2018 were Amer Sports, MTU Aero Engines and UCB. Finland-listed sporting-goods company Amer Sports received a takeover offer from a consortium of investors led by Chinese sporting-goods company Anta Sports Products. Shareholders have been recommended to accept the offer by Amer’s board of directors for 40 euros per share. Though the investment thesis was not founded on Amer’s potential as a take-out candidate, the investment team saw strong strategic rationale behind Anta’s indication of interest, as Anta seeks to expand outside of China and as Amer seeks to expand within China.

The leading detractors in 2018 were Valeo, Dürr, and Signify (formerly Philips Lighting). However, the 4th quarter was a period a higher portfolio activity and PMs were nimble and quick to react to adverse holdings. They exited the positions in Signify during the quarter, a Munich-based producer of hyper-pure silicon wafers. In the case of Signify, the investment thesis has not been playing out according to their expectations, and as a result, they have redeployed the capital elsewhere, after a strong share price performance since they bought it. They also exited the position in German capital equipment company Dürr, following increased pressure on automotive volumes, particularly in China. Capex expenditure in that region tends to drop significantly fast, with a lag against production volumes, as automakers seek to preserve cash by minimizing capex as much as possible. Dürr is most negatively exposed to this trend, and PMs therefore sold the holding.

During the 4th quarter of 2018, PMs initiated a position in AerCap. the investment is predicated on several elements. First, a strong global market for narrow-bodied aircraft, which is AerCap’s primary asset. Second, a management team with a track record of returning cash to shareholders and a history of selling aircraft above book value to buy its existing aircraft below book value via a share buyback, which provides a better return on capital for owners. And lastly, an attractive valuation and internal rate of return potential.

From a sector allocation standpoint, being underweight in Germany was also a positive contributor, particularly by not holding Bayer, Anheuser-Busch Inbev, BASF, Deutsche Bank, Deutche Post, Continental and Daimler.

Stock selection was disappointing in Q4 2018, especially in communication services and consumer staples. Over the course of the year stock picking in healthcare and real estate proved to be the major positive contributors whilst in materials and industrials, it deteriorated from relative performance.

Outlook

The fundamental impact of weaker economic growth on most European companies has so far remained largely muted, though the operating environment is clearly not as strong as it was a year ago. The automotive sector has proven to be something of a canary in the coal mine; however, even its downward share price moves have far exceeded declines in both reported earnings and changes to earnings forecasts for the coming years. Several sectors are now trading at valuation levels not seen in Europe since the height of the European financial crisis in 2012 (e.g., chemicals, automotive, metals and mining).

Anxiety levels within the equity markets are clearly high. Macro and political concerns have driven a sharp “risk-off” move in the last quarter of 2018. The leading sectors by performance in Europe were all defensive in nature: healthcare, consumer staples, communication services and utilities, while the hardest-hit sectors were cyclical, industrials and materials. This was reflected at the individual stock level as well. Though top-down moves can be painful on a quarter-by-quarter basis, such indiscriminate top-down-driven buying and selling can offer rarely seen opportunities for those willing to take a business ownership mind-set without being overwhelmed by short-term stock price moves.

PMs are increasingly excited about many of the Portfolio’s holdings, some of which are extremely provocatively valued. Some are higher-profile names, such as Peugeot, Valeo or Repsol, and others perhaps less well known, such as AerCap.

Investors are concerned and seeking safety, with fears around the global economy, trade wars, higher interest rates, China and the eurozone all stoking near-term worries. Volatility has returned to global markets. However, heightened uncertainty and fear have tended to bring up more attractive investment opportunities than environments of consensual optimism. PMs remain positive and ready to exploit these spreads to find companies with strong cash-flow-generation potential that investors might be missing.

WSP Analyst Conclusions

We hold lead PM Tawhid Ali and his co-PM Andrew Birse in high regards. Investment process displays distinctive features with a private equity mindset applying IRR methodology. This resulted in a time-tested and above average track record in the last decade.

In conclusion, we confirm AB Eurozone Equity Portfolio fund as our best choice in the Eurozone Large Cap Equity peer-group and we maintain this fund with the “Selected” status in our Master List.

L’équipe WSP [/private]