Investing in funds of managed futures trading, best known as CTA is a relatively new form of asset class in the UCITS format. It offers interesting diversification opportunity in terms of decorrelation to traditional asset classes, as well as an additional source of return. Managed futures traders have a wider range of return opportunities available compared with traditional stock and bond investors. However, as noted in statistical research (1) trend following, as well as volatility regime, are important characteristics for managed futures. Consequently, despite having delivered steady positive performances over the long term, CTA funds have also recorded lasting periods of flat or negative performance. It is therefore important to understand the underlying strategy of a fund and we must ask ourselves what is the best time to invest.

Is it better to invest in CTA funds after a positive or negative recent past performance ?

This analyse is supported by empirical findings, academic research, and a study done by the CTA specialists team at Candriam Investors Group.

Short term period

Here we compare the return over the last 3 months to the performance realised the following 3 months. As shown in the below graph investors that want to optimise their entry point in the strategy are better off investing right after a correction. One possible explanation to that peculiarity is the lagging effect. Where by waiting to invest in a fund after it has recorded good results investors would miss the first part of the trend CTA are exploiting.

Source: CTA Team, Candriam IG

Longer term period

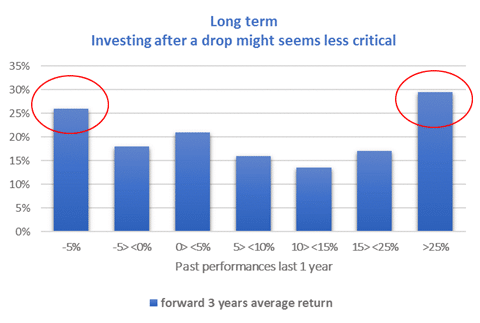

Over the recommended investment horizon of 3 years, the study has shown that the past performance right before investing, – consequently the timing of investment – has much less relevance than with a short term horizon. The below graph illustrates that the best performances have been realised by investing in the “fat tail”, hence after either negative or strong positive performances measured over 1 year period .

Source: CTA Team, Candriam IG

After a drawdown

As we have seen, in both time frame, investing after a negative performance seems an appropriate strategy. To illustrate, we can observe the CTA 1 year returns right after a loss of 5% and 10% respectively. During the period under review (1987-2016), the Barclay Systematic Traders index has recorded 118 loss of over 5%, from which 22 of more than 10%. After a 5% loss, the subsequent one year performance has been +9.7% in average, and +20.6% after a loss of 10%. Those figures tend to demonstrate that for investors wishing to optimise their entry point, the best timing might be after a substantial negative performance.

Source: CTA Team, Candriam IG

The authors of the study highlight that the average volatility from a basket of asset classes offers a good indicator to CTA future performance. While it is widely accepted that CTAs need an increasing volatility regime to perform, the authors believe instead the volatility needs to remain above a minimum to deliver good results.

Is is the good timing to invest in CTA ?

The Barclay Systematic Traders has recorded a drawdown of more than 8% loss since march 2015, reaching historical low in that metric. While causes of such drop are still around ( i.e., weak commodity, low volatility ), the market conditions coupled with the current volatility regime has made medium term investing into CTA funds more attractive than before. We would however wait a confirmation that a low point has been reached before considering such investment.

As mentioned at the beginning of this article, research shows the importance to understand the underlying characteristics of the CTA strategy to draw any meaningful conclusions about its performance. It is why in selecting a CTA fund manager at WSP we estimate the drivers that enhance returns by using multifactor models that span combinations of the traditional market factors with other factors representing dynamic trading, trend following, and momentum. Then, we assess the chance of a manager to enhance returns in an expected market conditions according to the the factors that might work the best.