Wishing you a healthy, enjoyable, and prosperous Year 2024

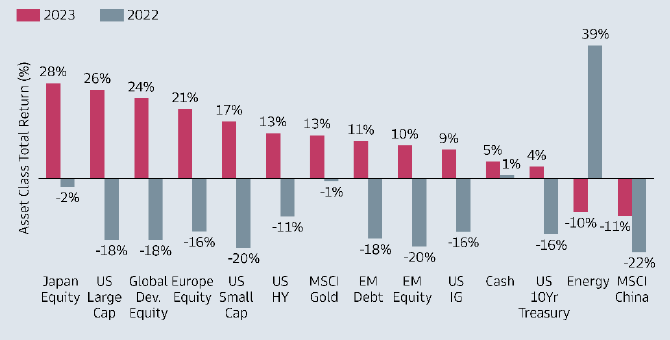

Equity and Fixed Income assets posted historically high but unexpected returns in 2023.

How portfolio managers will reposition portfolios for 2024 ?

In 2023, consensus were proven wrong by large, much like in 2022, but the circumstances were opposite to those of the previous year

Indeed, despite recession fears and a challenging investment environment, the year demonstrated economic resilience, marked by strong disinflation, healthy growth, and tight labor markets, supporting robust performance in risk asset classes.

Global Economic Conditions

- Inflation Slowdown: Global economies experienced a material inflation slowdown relative to their respective peaks late last year. This progress was seen as a positive step towards achieving the 2% inflation target set by major central banks.

- Central Bank Decisions: The inflation slowdown played a crucial role in recent central bank decisions to hold policy rates steady. It was believed that central banks were in the final stretch of the race to slow inflation without entering a recession.

Impressive Stock Market Performance

- S&P and Nasdaq: Despite initial concerns, the S&P climbed 24% in 2023, while the Nasdaq 100 had its best year since 1999, posting a 41% annual gain. This comeback was attributed to factors such as the artificial intelligence boom, stretched positioning, and the “fear of missing out” (FOMO).

The year felt more driven by macro factors (rates/inflation) and positioning than fundamentals, with subjects such as quality, leverage, and profitability mattering at various points.

- Market Themes: The year unfolded as a series of themes, with AI being the leading story, followed closely by other factors like GLP-1, energy dependency, weak balance sheets, refinancing risks, and geopolitical events such as the Middle East conflict.

Investor Sentiment and Challenges

- Perplexing Year: Investors faced a perplexing and challenging year in 2023. Initial expectations of a looming recession and consumer slowdown were challenged by early positive surprises, including the gas/energy crisis and earnings strength.

- Var Shocks and Macro-driven Market: The year felt more driven by macro factors (such as rates and inflation) and positioning than fundamentals. Var shocks, including events like regional bank issues, CS failure, and geopolitical tensions, added to the complexity.

- Goldilocks Dynamic: Solid growth, lower inflation, and high employment pointed to an ongoing Goldilocks dynamic. Consumer resilience was expected to hold up, with cuts factored in for 2024.

Source: Bloomberg, Goldman Sachs AM, WS Partners. As of 29 December 2023

Outlook 2024

Baseline scenario is for a soft landing in 2024 with disinflation forces at play and ultimately dovish monetary policy by the FED and ECB.

Here is an highlight of outlook published by picked global portfolio managers.

Global Economic Conditions

- Mild recessions is anticipated in developed markets, with interest rate cuts in H2 2024. (Vanguard).

- A weaker global economic outlook predicted, mainly driven by a slowdown in Developed Markets (DM), with a potential US recession in H1 2024, but positive prospects for Eurozone growth and resilient Emerging Markets (EM). (Amundi)

- A global growth slowdown in H1 2024 is forecasted with variations in individual economies: US resilient, Eurozone in flat growth, Chinese growth stabilizing, but expects a recovery thereafter. (Invesco)

- 2024 expected to be a year of transition, higher tension, and growing protectionism, favoring certain regions. (Amundi)

- Limited recession risk with a reaffirmed 15% US recession probability. Tailwinds for global growth, including real household income growth, reduced drag from monetary and fiscal tightening, manufacturing recovery, and central banks’ willingness for insurance cuts. (Goldman Sachs)

- Anticipation of a moderate economic contraction followed by a return to growth in late 2024 or early 2025. (Fidelity)

Interest Rates and Structural Changes

- Interest rates expected to remain above inflation due to demographic changes and productivity gains from AI. (Vanguard)

- Expectation of faster-than-expected cuts from the US Federal Reserve in the later part of 2024. Nominal bonds expected to perform well during this period. (Fidelity)

- 2024 is seen as the “year of the bond” after global interest rates peaked in October 2023, positive outlook for global credit, high-yield, and emerging markets. (Vontobel)

- Peak policy in various regions, with the US easing expected to begin late in H1 2024. (Invesco)

- Most major DM central banks likely finished hiking, with rate cuts expected in H2 2024. Expectation of central banks leaving policy rates above current estimates of long-run sustainable levels. Bank of Japan’s potential exit from yield curve control and rate increase in H2 2024. China’s near-term growth benefiting from policy stimulus, but a multi-year slowdown likely to continue. (Goldman Sachs)

By Asset Classes

Fixed Income

- A soft landing, supporting global credit, high-yield, and emerging markets is predicted. (Vontobel)

- A golden age for fixed income investing amid the end of the Great Moderation is seen. (PGIM)

- Bumpy transition to a higher interest rate environment. Expectation of much better forward returns on fixed income assets. Balanced asset mix recommended, with a greater role for duration in portfolios. (Goldman Sachs)

- Above-consensus inflation expected in the first half of 2024. Upside inflation surprises could lead to outperformance of inflation-linked bonds. Favoring medium-duration inflation-linked bonds over nominal ones in this scenario. Money market funds suggested as an alternative for cautious investors if yield curves remain inverted. Favoring short-dated, high-quality credit (in GBP, for example) in this scenario. (Fidelity)

Equities

- Opportunities for equities as the recovery takes shape after a forecasted global growth slowdown in H1 2024. Recognition of increased dispersion within and between equity sectors and styles. (Invesco)

- Equities expected to fare well if a recession is avoided in 2024, particularly those with durable earnings growth and innovation driving secular growth, particularly in artificial intelligence. (PGIM)

- Small and mid-cap stocks expected to perform well in Europe, evidenced by their impressive outperformance vs large cap since last October, as long as the reduced inflation dynamics suggest an unlikely tightening by the US and European central banks (Bellevue AM).

- Market outlook complicated by compressed risk premia. Expectation of returns in rates, credit, equities, and commodities exceeding cash in 2024. Balanced asset mix recommended, replacing 2023’s cash focus. (Goldman Sachs)

- Cautious approach to overly optimistic earnings expectations, opportunities are seen in finding undervalued stocks, particularly in markets such as Europe and Japan, and sector preferences such as financials in the European market, bond proxies such as utilities, consumer staples, and healthcare in the context of a potential cyclical recession. (Fidelity)

Private Markets

- Opportunities in private real estate identified due to deep discounts (PGIM).

- Private credit profiting as banks retreat, offering enhanced income and return potential (PGIM).

- Opportunities to take on more risk in real estate assets, as property prices have adjusted, especially in Europe and the UK.

Currencies

- The US dollar may weaken if the Fed eases, benefiting EM currencies, and potential benefits for Japanese Yen if the Bank of Japan starts to normalize. (Capital Group).

Thematics Investing

Innovation and Technology

- Innovation driving secular growth, particularly in artificial intelligence (PGIM).

- Innovation in Europe, suggesting looking beyond the US for investment opportunities (Capital Group).

Emerging Markets

- Opportunities seen in emerging markets other than China, citing infrastructure growth and supply chain shifts (NinetyOne).

- Manufacturing revival in emerging markets due to a capital spending boom (Capital Group).

Sustainability and Green Transition

- Focus on financing the green transition in fiscal policies (Amundi).

- Capital spending boom is seen in the US to support clean energy and sustainability initiatives (Capital Group).

Dividend Payers

- Out-of-favor dividend payers recommended for diversification and income in a potentially recessionary environment (Capital Group).

Active Funds Selection

Last year saw a continuation of 2022 for equity fund managers with a scarcity of true alpha generated, while fixed income managers benefitted from tailwinds from stabilising rates and rates cut anticipation

2023 has not been a smooth year for equity fund managers, with many different performance periods, and several up and downs. Each with different drivers and leaders from both a style and sector perspective. It started with an initial recovery rally in January, followed by fears of a US banking crisis in March, then the 2nd quarter saw an AI driven growth rally, the higher for longer rate expectations was the main narrative from July to October and finally the year ended with another strong rebound driven by interest rate cut hopes.

Top Picks from our Selection

In this context of scarce alpha, some of our selected strategies have withstand well and outperform their respective benchmarks. We review some of them hereafter and provide key performance drivers and explanation. Compared to peer groups, our selection again stayed at the top in 2023.

Emerging Markets Equity

Artemis SmartGARP Global Emerging Markets Equity Fund

The emerging markets disappointed in 2023. Despite a rebound in sentiment in the last quarter, EM stocks ended the year well behind developed markets. Against this challenging backdrop, the active approach of the Artemis SmartGARP Global Emerging Markets Equity Fund performed well, ending the year up +15.7% (in USD terms) compared to the index at +9.8%. It has been achieved providing diversification against more popular growth driven approaches in the sector.

The fund outperformed the MSCI EM Index over 1,3, 5 years and since inception in September 2018. The value bias remains substantial, the current portfolio displaying a 45% discount relative to the market. Fundamental value per share of the holdings held has outgrown the market by 7% per annum since launch.

During the last quarter, the fund lagged by -1.9% with negative stock selection but throughout 2023 the stock picking contributed positively.

Signs of a bottoming in the tech hardware cycle encouraged the Portfolio Manager, Raheel Altaf, to reduce the underweight exposure to the sector at the end of 2023. He has been adding to mega caps such as TSMC, Samsung, Tencent and Netease. Il also added more cyclical stories like Star Bulk Carriers, Hankook Tire and Copa.

The result of these changes is that the fund continues to offer an attractive combination of extremely low valuations and attractive growth prospects. The forward price/book ratio of the fund is 0.9x and it offers a forward P/E of 6.6x vs 12x for the index. This discipline in valuations is likely to be a rewarding strategy as we progress through 2024 and for the years ahead.

The fund remains overweight China, Brazil and Korea and underweight India, Taiwan and Saudi Arabia. At the sector level, financials, consumer discretionary and energy feature are the largest overweights. Materials, media & entertainment and consumer staples are the largest underweights.

China remains a key focus for global investors. For much of 2023, Chinese equity markets suffered from weaker sentiment. The Chinese economic recovery has so far been underwhelming. But positive catalysts such as reforms and growth initiatives have the potential to surprise investors.

EM stocks are cheap and unloved, but pessimism is now well reflected in prices. They are trading on multi-decade valuation lows against developed markets across a range of metrics. EM economies are ahead of the cycle and have started easing. More flexibility around monetary and fiscal policies is causing diverging policy paths with the west and supporting economic growth prospects ahead.

Global Equities – Thematics

Robeco Global Consumer Trends Fund

Global stock markets staged an impressive rebound from the worst year in 2022, since the 2008 Great Financial Crisis. The market climbed the traditional ‘wall of worry’ last year as investor were concerned about inflation, rising interest rates, an increasing geopolitical tension for most of 2023. The majority of the market’s gains came in the first six months as technology stocks recovered, led by the Magnificent Seven group of companies consisting of Apple, Amazon, Alphabet, Nvidia, Meta Platforms, Microsoft and Tesla. An index representing these seven stocks returned 107% in 2023 and the combined weight of group in the MSCI All Country World Index reached nearly 17%.

Last year, the Robeco Global Consumer Trends fund returned +34.3% (in USD) compared +22.2% for the MSCI All Country World index.

The bias towards quality growth stocks in this fund was really a positive factor. All three of the trends implemented in the strategy, i.e the digital transformation of consumption, the rise of the emerging middle class, the increased consumer focus on health & wellbeing, delivered a positive contribution to the overall return. 2023 has been a good year for the fund overall, but on an individual stock level a handful of large winners stood out, while some missed out on the market rally entirely.

The digital transformation of consumption sub-theme delivered by far the strongest positive contribution and artificial intelligence was responsible for a large part of it. 2023 will go down as the year of the ChatGPT launch and with 100 million users within two months, it became the fastest-growing consumer app in history. Stocks with exposure to the broader AI theme surged as investors think the market is in the early innings of a long-term AI technology boom. Nvidia shares soared +239% last year, taking the company’s valuation well above the one trillion dollar mark. This means Nvidia joins tech giants Apple (+48%), Amazon (+81%), Alphabet (+58%) and Microsoft (+57%) in the elite club of USD 1 trillion companies.

The defensive holdings in the health & wellbeing bucket performed in line with the overall market. This sub-theme is expected to lag the overall market in high positive return years and provide downside protection in the tougher years. The top value creator in this segment was Lululemon Athletica.

Finally, the emerging middle-class bucket contributed positively to the overall return of the strategy. Shares of Chinese ecommerce platform Pinduoduo rose +79%.

Global Equities – Thematics

Guinness Global Innovators Fund

In 2023, the Guinness Global Innovators fund exhibited a total return of +31.7% (in USD), compared to the MSCI World Net TR Index return of +20.1%, therefore outperforming by +1560 bps. The fund also outperformed its Global Equities peer group average by +19.4%.

During the year, the fund benefitted from a number of tailwinds, including a rotation back towards growth over value, greater risk-on sentiment driving the outperformance of cyclicals vs defensives, alongside developments in artificial Intelligence, one of the nine key innovation themes in which the fund has significant exposure to. Whilst we would expect the fund to outperform in such an environment, we are pleased with the magnitude of outperformance over the year, with returns not just ahead of the MSCI World Index, but the MSCI World Growth index too. The fund remains in the top quartile versus peers across 1, 5 and 10 year periods, and in the second quartile over a 3 year period, despite the varying market conditions seen during the past few years and particularly the difficult environment for growth stocks during 2022. The focus on quality growth at-a-reasonable-price has helped the fund in more difficult market environments, not only benefitting from businesses who are able to withstand more difficult demand periods with strong balance sheets and higher margins, but also avoiding the volatile non-profitable tech businesses that have swung between large rises and falls, and often underperforming over longer time frames.

This year of significant outperformance for the Guinness Global Innovators fund followed a year of significant underperformance. Whilst the equally weighted Bloomberg Magnificent 7 Index rose 107% over 2023, it is only up 13.2% over the two-year period 2021-2023. The Magnificent Seven’s bounce was largely reflective of trends seen across the market: the worst performing sectors in 2022 were the best performing in 2023, and the best performing in 2022 was one of the worst in 2023. Whilst we recognize that the positive performance seen by the Magnificent Seven is in part driven by a reversal in market sentiment (and perhaps a reversal of overselling last year) we believe that a core driver of this performance has been an improvement in the fundamental outlook for these stocks.

Unsurprisingly, the top 5 contributors to performance were focused on the AI theme, namely Nvidia, Meta platforms, Salesforce, Lam Research and Amazon. On the other hand, the top 5 detractors were ANTA Sports, Paypal, Bristol Myers Squibb, Nike and Thermo Fisher Scientific.

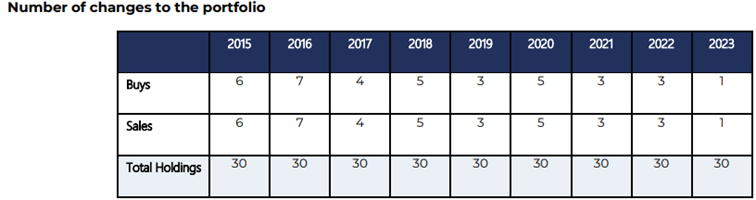

The investment team sold one position (Bristol Myers Squibb) and initiated one new position (Novo Nordisk) over the course of 2023. This switch occurred during Q3. 2023 appeared to be below historical numbers in terms of name turnover as shown in the table hereafter:

Source: Guinness Global Investors

Over 2023, the net effect of purchasing Novo Nordisk whilst selling Bristol Myers-Squibb had no effect on the fund’s sector exposures, with both stocks within the healthcare sector. This did, however, slightly shift geographic exposure towards Europe and away from North America, although the portfolio continues to have a bias to the U.S and an underweight position to Europe and Asia. Sector-wise, the strategy remains heavily skewed towards the technology sector (56.2% of the portfolio), representing a36.1% overweight compared to the index.

The fund has good exposure to the long-term secular Artificial Intelligence trend, investing in a number of the leading enablers and integrators within the space, and this has been the key driver of performance over 2023. However, the fund is diversified across a number of other long term secular themes, that should benefit from continued growth prospects with less sensitivity to the broader economic cycle.

US Equities – Small and Mid Caps – Long/Short

Prosper Stars & Stripes Fund

For the full year 2023, the Prosper Stars & Stripes fund generated a net return of +15.2% compared to a total return of +10.4% for the HFRX Equity Hedge Index and +16.9% for the long-only small cap Russell 2000 Index. Average daily net exposure was 42.2% compared to a 43.2% average since inception in January 2010.

The long book’s rate of return was approximately +33% relative to the Russell 2000 total return of +17%, driving a 2023 active contribution of almost 10% on a gross basis. U.S. market leadership was narrow for the year with 7 stocks driving 64% of the total return of the S&P 500 and 76% of the total return of the Nasdaq 100.

In contrast, the fund’s long book had 20 individual investments that returned more than +50% during 2023, 45 individual investments returning more than +20%, and 76 individual investments adding positive alpha. This is consistent with the fund’s history of consistent and broad contributions from a breadth of positions.

FTAI Aviation was the top contributor to fourth quarter and full year long performance. The fund has consistently invested in the aerospace industry due to several positive characteristics. It is highly regulated to ensure the highest possible safety standards, which creates barriers to entry. The industry also operates on long-term production schedules, which creates visibility. These attributes tend to enable consistently higher-than-average profit margins.

The fund’s short book outperformed during the fourth quarter and second half of 2023. Like the long book, the breadth of the short book supported returns with 20 investments in the fourth quarter declining by more than -10%, and 70 short investments declining by more than -10% during all of 2023. In terms of active contribution, the short book had 54 individual investments contributing positively during the fourth quarter despite the surge in markets, and 98 individual investments producing a positive active contribution for the full year.

With a nuanced outlook, Christopher Hillary, the lead Portfolio Manager continues to see opportunities to drive investment returns with company-specific drivers. Sotera Health and Barnes Group, among the largest holdings in the long book are representative of Hillary’s general interest in healthcare and commercial aerospace trends. He consistently deploys capital to the healthcare sector to benefit from powerful demographic trends that are driving secular growth in health spending. He generally focuses on identifying the ‘picks-and-shovels’ business models that enable research and production efficiency gains. These companies benefit from a multitude of drivers and generally have, or can develop, compelling financial characteristics.

The short side of the portfolio continues to target a combination of thematic and company-specific investment opportunities. Like the long portfolio, certain short investments rely more on one of these archetypes than the other, while many include a balance of the two. Christopher Hillary, the lead Portfolio Manager anticipate that growth will be more difficult to attain for companies operating in the travel and leisure industry as consumer spending here has more than fully recovered from the pandemic.

Fixed Income – Emerging Markets

Barings EM Local Debt Fund

The fund aims to achieve long-term total return through investment in a diversified portfolio of EM local currency-denominated debt securities. Its target objective is to outperform the JPMorgan GBI-EM Global Diversified Index by 200-300bps per annum gross of fees.

Emerging markets debt ended the year on a high note, posting its largest quarterly gain since 2020, bringing the gain for 2023 into double digits across both sovereign credit and local debt.

US Treasury yields fell substantially at the end of the year, dropping -113 bps from October 19th, when they briefly yielded 4.99%, the highest level in over 15 years. Global headwinds have become tailwinds in the last six weeks as markets are now pricing in that the Federal Reserve will deliver 125 bps of cuts in 2024.

Currencies also delivered their highest monthly returns of 2023. The narrative in many EM countries remains the same; inflation is well-behaved and Central Banks are actively cutting rates. Brazil, Peru and Hungary all delivered rate cuts in November as did another half dozen EM central banks in October. DM Central Banks appear to be rhetorically retreating from the “higher for longer” chorus the Fed was promoting in September and October.

In 2023 the fund delivered a performance of +15.9%, substantially higher than the benchmark (+12.7%). Most notably the overweight in South Korea, South Africa, Peru, Chile, Mexico, Czech Republic, and Hungary were strong contributors, as well as their exposure to Israel (both rate and currency). Also to notice is their zero exposure to Egypt which contributed positively.

The fund has at the end of the year a yield-to-maturity of 7.8% (in USD) for 6.4 years of duration and a BBB+ rating average.

Fixed Income – Global Total Return

Solitaire Global Bond Fund

The Fund invests in bonds globally, without geographical or sectoral limitations. The investments are predominantly (min 90%) in USD. It is actively managed without reference to a benchmark (total return). It is however a high-octane strategy with a permanent bias towards sub-investment grade issuers (EM or Corporate HY).

In 2023 all performance drivers contributed positively. The coupon income contributed to +8.0% while the duration contributed to +0.6%, the spread to +3.2% and the selection to +1.7% to the performance. Overall, the fund had a gross return of +13.4%.

Last year has been a great example of how investors should focus on fundamentals and make investment decisions based on the quality of the issuers rather than chasing market noise. Disciplined managers working on seizing the most attractive names, backed by solid fundamentals, have thrived in such an environment.

According to the Portfolio Manager, entering 2024, the rationale for bonds stays unchanged: yield, carry, and strong balance sheets are there, providing an exciting chance for investors.

The fund had at the end of the year a yield-to-maturity of 9.7% (in USD) for 4.8 years of duration and a BB- rating average.

Fixed Income – Aggregate Total Return

TCW Unconstrained Bond Fund

The fund is an aggregate strategy with a total return approach, investing in sovereign, investment grade and high yield corporates, MBS, and emerging markets bonds hard currencies. The duration is actively managed between 1 to 4 years and the average credit quality is always IG, providing the fund a defensive stance.

The fund delivered a performance of +8.1% vs. +7.2% for the Bloomberg Global Aggregate TR Hdg USD in 2023. This good performance should also be put into perspective, bearing in mind that the fund had already outperformed its index by more than 340bps in 2022.

Duration remained at the high end of the scale (4 years) all over the year. The outperformance came essentially from their strong exposure to ABS (mainly MBS). They saw and still see this sector as the best value opportunity in the market. Agency MBS are for instance trading with a higher spread than IG corporates while issued by government-sponsored agencies.

Forward looking, they see a greater risk of a hard landing than the markets are pricing in. Consequently, they are also expecting the FED to decrease interest rates more aggressively. This is the reason the duration will stay at the high end of their scale. They also will remain prudent on corporate credit risks where they expect the default rate to increase. Finally, defensive MBS remains their strongest relative value conviction.

The fund had at the end of the year a yield-to-maturity of 6.6% (in USD) for 3.5 years of duration and a BBB rating average.

WSP Selection

includes more than 120 funds,

across 72 strategies in equity, fixed income, alternative asset classes and ESG/SRI,

selected from a universe of more than 50 asset managers.

25 Sustainable Investments funds

across 15 sub asset classes have been added to it.

Watch list is still at more than 90 funds of interest to us, either for their unique strategy or process.

Our Model Portfolios of active funds have delivered positive performance but scarce alpha

As already discussed above 2023 has been a repeat of previous year by being challenging for active management, especially for equity fund managers. Highly polarised equity markets, resulting into strong outperformance by mega-caps, gave little room for actively managed portfolios to differentiate themselves from their benchmarks .

This backwind in our mixed assets portfolios was partially compensated by our fixed income allocation. We have benefited greatly from the tightening of credit spreads on high-yield, loans, and CLOs strategies during the year. Our alloction on Cat bonds funds also paid off (+14.2% ) and significantly contributed.

With regards to our Balanced Portfolio, all the absolute return strategies recorded also positive performance in 2023. They were lagging in relative terms due to inherent low beta exposure to mainstream asset classes, while they contributed to reduce the portfolio’s volatility.

We have developed and managed various model portfolios made of active funds exclusively for our client with the aim to deliver superior returns from markets and alpha generation.

The oldest portfolios have been launched more than 6 years ago: Three multi-asset portfolio profiles in two base currencies; US dollar and Euro.

Yield & Income Portfolio (2/3 fixed income – 1/3 equities), the most conservative strategy, gained +12,7% in 2023 (USD), or +89bps vs its benchmark (2/3 Barclays Global Agg – 1/3 MSCI All Countries).

Balanced Portfolio (1/3 fixed income – 1/3 absolute return – 1/3 equities) performed by +11.0% (USD) , lagging by –341bps vs a benchmark without absolute return component (50% Barclays Global Agg and 50% MSCI All Countries).

Growth Portfolio (1/3 fixed income 2/3 equities) recorded the highest absolute return at + 14.7% (USD), while lagging by -234bps its benchmark (1/3 Barclays Global Agg – 2/3 MSCI All Countries).

As a reminder, all strategies are 100% invested at all times and the balance between fixed income and equities remains unchanged. As a result, most of the relative performances are coming from the alpha generated by the selected funds and intra-asset styles biais.

WSP Model Portfolios are built from a universe of selected funds

Winning engagement with prospects and enriching relationship with customers.

Our development goal is based on customers acquisition as well as, and most importantly, by extending the depth and breadth of our services with existing customers. We have been successfully rewarded this year with the onboarding of sizable new customers including a private bank in Monaco, the launch of an on-line fund reports library, and successful executed fundraising operations in private equity and private debt markets.

We are engaging with customers by delivering tailored solutions in fund portfolio monitoring and risk management, by enhancing their selection process, as well as helping them to match compliance requirements. For many, this has led to a significant improvement in key aspects of their financial services offering, making a real difference.

We expect a year full of known and unknown events, opening opportunities for astute active portfolio managers and asset allocators to add alpha to their portfolios.

The equities in developed markets are starting the year at high valuations, while the emerging markets are offering better opportunities at attractive valuation. This time, the Federal Reserve is expected to pause hiking, before cutting rate lately. The ECB is expected to followed but with a lag.

Liquidity restrain might ease supporting risk assets investments and releveraging in markets.

In 2024, we will pursue our effort to capitalise on the success of our fund selection process, the quality of our due diligence, and to develop a strong platform to give access to private markets to our clients. To achieve that, we will focus on the following:

Funds due diligence and analysis

The new financial regulation in Switzerland will require financial institutions, large and small, to re-evaluate their investment selection and risk management to align with stricter compliance requirements.

In this regard, our due diligence and selection capabilities is based on the highest standards of quantitative, but more importantly, qualitative analysis that we have always applied for institutions subject to international regulations. The use of IA and machine learning will help us to greatly improve our efficiency in that task.

The launch of our on-line library of fund analysis report will contribute to spread our expertise to your benefit. This library is dedicated to professional investors seeking an independent analysis or opinion on a specific fund.

We reiterate that our objective is to position Wealth Solutions Partners as the partner of choice to support your business successfully and efficiently within the LSFIN/LEFIN framework.

Fund selection for independent wealth managers

We will still improve the quality of services available on the OpenList platform, available exclusively and free of charge to Wealth Managers in Switzerland since 2018.

Sustainable investments

We continuously adjust our selection process to integrate the ever evolving regulation and taxonomy in ESG investing to serve customers seeking to combine returns with environmental and social benefits.

Private Markets

Finally, we will continue to provide access to our customers to selected opportunities into private markets by using our best practice in investment analysis and an extensive capital raising network. For that purpose we offer you a dedicated SV fund in Luxembourg, an efficient structure to invest into private assets a reliable solutions combining transparency and safety within a highly regulated framework.

We have already a highly attractive pipeline of selected deals to introduce to our customers in pre-ipo and real-estate markets.

We reiterate here again that we would like to bring to the community of investment professionals, institutional investors and private banks our deep knowledge and extensive experience with the aim to deliver cost effective due diligence, investments research, fund selection and portfolio consulting services in a true open architecture model.

In the current complex world, investment professionals will seek more and more to establish partnerships with knowledgeable, well experienced specialists able to understand and connect them to the world’s best solutions to grow their business successfully. We want to be one of those partners delivering with quality, value, and independence, innovative solutions.

Best Wishes

The WSP Management Team