Wishing you and your loved ones a healthy, enjoyable, and prosperous Year 2022

Well, after the S&P 500 raising by +27%, the third double digit yearly return in a row,

how do we feel now ?

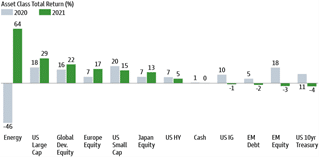

The year 2021 has been a year of transition in many aspects with a recovery and expansion fuelled by vaccine campaigns and dovish policies.

Amid worldwide supply chain disruptions, unprecedented meme mania, persisting inflation and finally concerns about a mutating virus, risk assets again performed strongly though with heighten volatility and punctuated by harsh regional, factor and sector rotation:

“ ….For instance, Indian equity and energy-focused funds achieved a u-turn in their 2021 performance compared to the previous year, according to research from Fairview Investing and data from FE fundinfo, with the four worst funds of 2020 all featuring in 2021’s list of the top six best performers” ( Lauren Mason, Intl Investment, 4 January 2022)

Source: Bloomberg, Goldman Sachs AM, WS Partners. As of 31 December 2021

In this environment active managers struggled to deliver stable and consistent alpha.

Private markets on the other hand have known one of their best years ever, with the US private equity experiencing its fastest pace of deal and exit activity in at least two decades, according to Pitchbook latest Quantitative Perspectives report.

Aggregate exit value has spiked, driven by the increasing valuations across all exit types—but especially public listings.

Some stats about IPOs; global issuance topped $1.4tn, with US IPO issuance totalling $151.5bn from ~320 offerings – the highest-ever volume-wise and most by number since 2000 (353). EMEA IPO issuance was of ~$90bn, largest volumes since 2007 and 294% increase vs 2020 volumes with a total of 186 deals over $100M.

In 2022 growth is expected to moderate on the back of monetary policy focus on curbing inflation.

This, coupled with lingering supply chains disruptions could introduce more business-cycle and market volatility, and returns might be driven more by fundamentals than hype this time.

Climate and climate policy risks in portfolios are deemed to grow in importance pressed by the net-zero pledged by public but also private sector.

For instance, in an annual letter to clients, Blackrock, the world largest asset manager, said it was “committed to supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner” and taking a number of steps “to help investors prepare their portfolios for a net-zero world”…

At the current real rates and spreads, fixed income investors will rely almost exclusively on tactical skills of portfolio managers to generate income.

Opportunities likely to draw attention range from short duration credit, loans and collateralized loan obligations (CLOs) to China bonds and European corporate hybrid securities according to those managers.

By the playbook, inflationary expansion should support cyclical over defensive sectors, value over growth stocks, smaller over larger companies and non-U.S. over U.S. markets.

However, we are aware that markets are increasingly unwilling to play by the rules, boosted by hyper accommodative central bank’s policies.

This time will be different?

Mind the liquidity that has been and will be the key factor driving valuation-stretched markets.

While 2020 was a vintage of anthology in alpha creation, last year saw a reversal of that situation with a scarcity of true alpha generated, and plenty of luck among the outperformers.

Alpha generation in 2021 was on aggregate below numbers of the 2020 outlier, but closer to historical averages.

23% of active US equity funds outperformed their respective benchmarks,

36.1% for European equity funds,

47.7% for Japan equities and

52.3% for Global Emerging markets (GEM) funds.

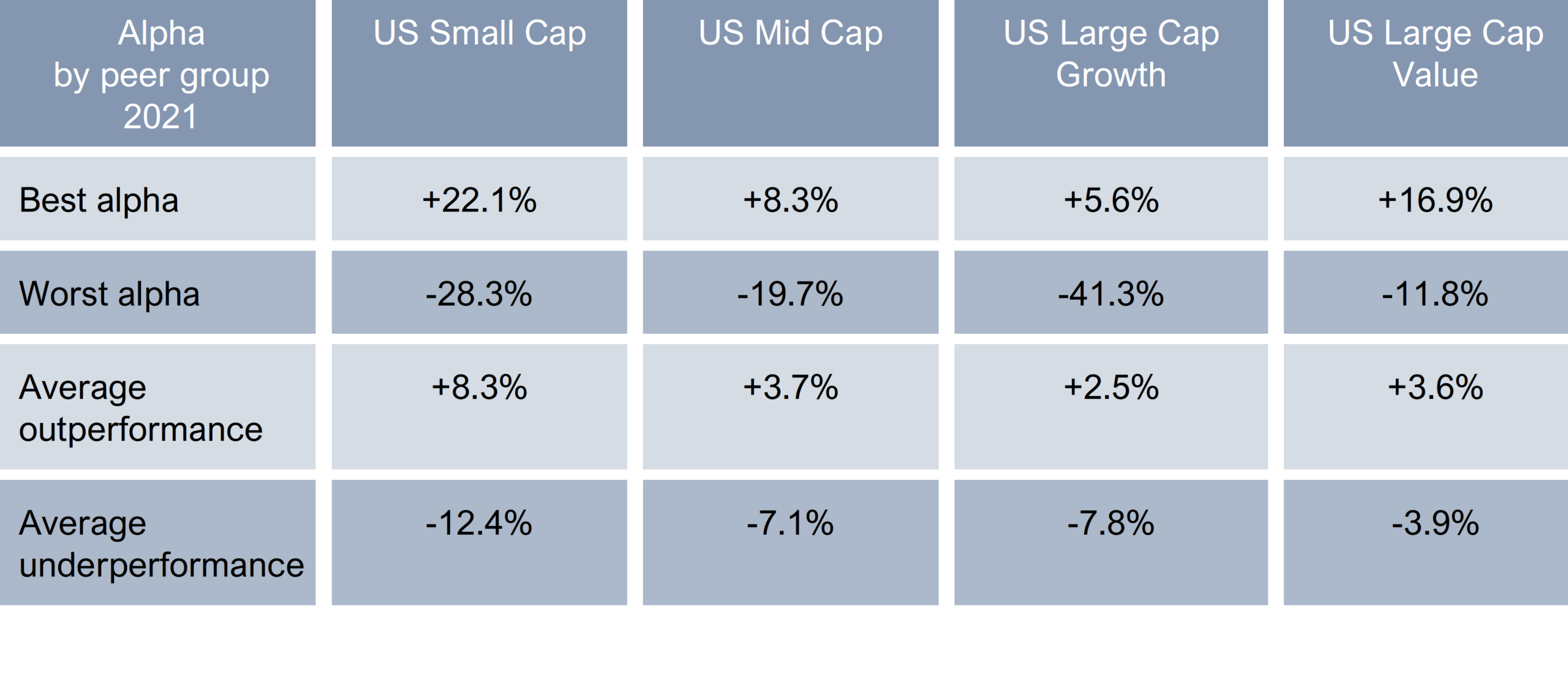

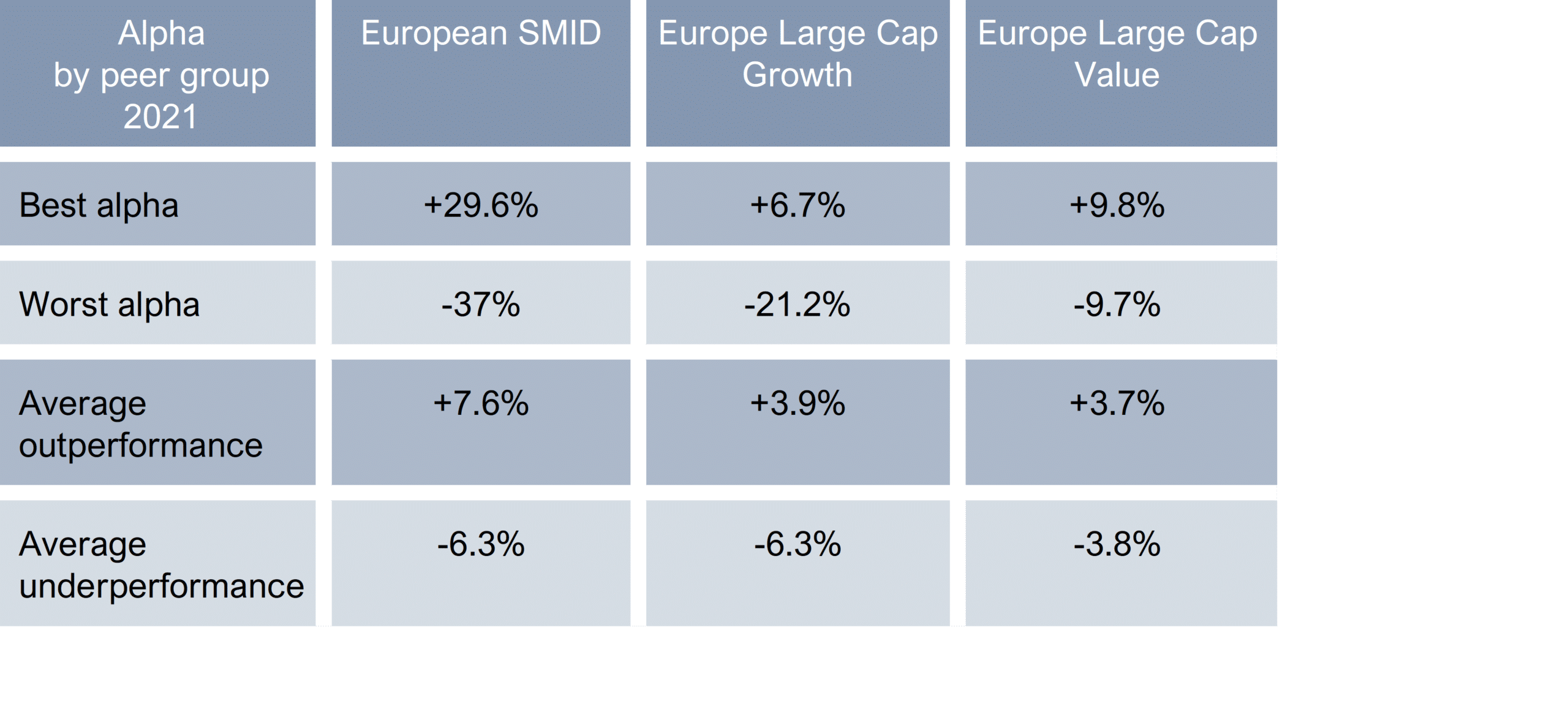

Looking under the bonnet, we find much more granularity and information, reflecting the challenges of 2021 for stock pickers. Across all regions, growth managers experienced a dreadful year, particularly in the US.

The very narrow market breadth, focused only on a handful of stocks leading the US equity markets was an insuperable hurdle for active management which is by definition diversified and risk-aware.

Only 11.4% of Large Cap Growth US funds managed to outperform the Russell 1000 Growth, and only 24% of Large Cap European Growth managers outpaced the MSCI Europe Growth Index.

At the other hand of the spectrum, the hit ratio of Value managers was much higher:

49.3% of US Value managers and 54.8% for Value European funds outperformed their respective value benchmarks.

One striking conclusion in 2021 is the distribution of alpha within each peer group, measured by best and worst funds coupled with their average out/underperformance.

To make a long story short: if you invested in an underperforming US or European growth fund in 2021, you significantly underperformed the index while if you picked a “good” growth fund, you would have outperformed by a much lower pace.

Alpha distribution was clearly skewed and asymmetrical. “Loosers” underperformed often twice more than “winners” outperformed in some peer groups, this statement was particularly true for growth strategies as shown in the tables below:

Those numbers highlight the need for fund selection capabilities to identify over the long run the best performers in each peer group, having in mind that mistakes can be painful for relative performance.

Finally, there are still some common conclusions worth to highlight. Even if ETFs have been favoured by investors in recent years, alpha can be generated by some experienced and astute stock pickers.

But it is fair to say that active management definitely makes more sense in inefficient opportunity sets such as GEM or small & mid-caps across geographies.

Alpha opportunities are scarcer in large cap peer groups, largely dominated by passive flows.

Our selection still records strong Alpha over long period, while over the short term results have been mixed compared to the outstanding year 2020.

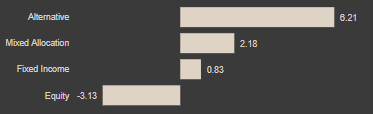

Alpha creation in our selection remains robust. Last year, in a very challenging period our selection of fund managers generated alpha in most asset classes, except for some equity funds.

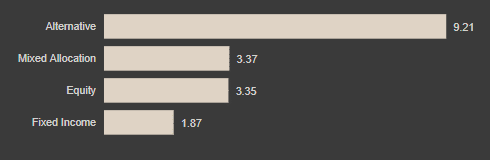

Therefore, in aggregate alpha finished –74bps, dragged down by equity funds ending -313bps in average, while fixed income funds achieved nice results at +83bps average alpha, yet ranging from +570bps to -520bps, depending on the benchmark considered.

Again, this time the alternative UCITS funds average outperformance has been a robust +621bps, mainly due to a multi strat and a long/short equity funds having delivered double digit excess returns.

-74bps average excess return in 2021, vs +530bps in 2020.

+287bps average annual excess return over 3 years.

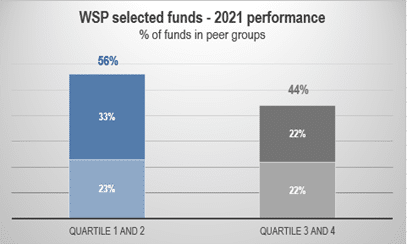

Compared to peer groups, our selection again stayed at the top in 2021

Most funds delivered performance ranking in the first and second quartile of their categories. The results are better if we consider the 3-year performance period, the standard measure for evaluating a fund manager’s performance:

In 2021, 56% of selected funds achieved an annual performance in the first or second quartile of their peer group (graph 1), while 77% of them ranked in the same quartiles over three years performance (graph 2).

Chart 1 – WSP selection universe – 1 yr return ranking

Chart 2 – 3yrs return ranking

WSP Selection

includes more than 120 funds,

across 72 strategies in equity, fixed income, alternative asset classes and ESG/SRI,

selected from a universe of more than 50 asset managers.

25 Sustainable Investments funds

across 15 sub asset classes have been added to it.

Watch list is still at more than 90 funds of interest to us, either for their unique strategy or process.

Model Portfolios of active funds have delivered positive performance but scarce alpha

2021 has been challenging for active management, particularly on the equity side. Style and sector rotation, underperformance of small and mid-caps, have been the main factors of underperformance.

We added our exposure to value funds at the beginning of 2021, which proved to be the right move, but didn’t fully compensate the underperformance of growth and small cap managers. Our slight overweight exposure in emerging markets has also contributed negatively.

On the fixed income side our underweight duration exposure has been a significant factor of outperformance.

Then, it doesn’t come as a surprise, that the Growth portfolio (2/3 in equities) had the worst relative performance, while the Yield and Income Portfolio (2/3 in fixed income) outperformed in 2021.

We have developed and managed various model portfolios made of active funds exclusively for our client with the aim to deliver superior returns from markets and alpha generation.

The oldest portfolios have been launched more than 5 years ago: Three multi-asset portfolio profiles in two base currencies; US dollar and Euro.

Yield & Income Portfolio (2/3 fixed income – 1/3 equities), the most conservative strategy, gained +5,0% in 2021 (USD) vs. +4.9% for its benchmark (2/3 Barclays Global Agg – 1/3 MSCI All Countries).

Balanced Portfolio (1/3 fixed income – 1/3 absolute return – 1/3 equities) performed by +6.6% against +8.3% for a 50% Barclays and 50% MSCI benchmark.

Growth Portfolio (1/3 fixed income 2/3 equities) contrary to 2020 where it outperformed its benchmark by +490bps, in 2021 it performed by +6.7% (USD) vs. +11.7% for its benchmark (1/3 Barclays Global Agg – 2/3 MSCI All Countries).

As a reminder, all strategies are 100% invested at all times and the balance between fixed income and equities remains unchanged. As a result, most of the relative performances are coming from the alpha generated by the selected funds.

Income Alternative portfolio, we manage since January 2019, is a portfolio mostly focused on private debt with the aim to capture the available liquidity premium to deliver libor +4% return with minimal volatility, thanks to a diversified portfolio of stable income-oriented funds. We seek strategies from which, most of the performance is generated by their income with relatively short maturities such as; trade finance, bridge loans, litigation, supply chain financing, peer-to-peer lending. It results in a portfolio returning +6,9% in 2019 (USD), +4.7% in 2020, and +5.0% Ytd as of 30.11.2021 with a volatility of 2.5%.

WSP Model Portfolios are built from a universe of selected funds

ESG funds selection and research

Climate and climate policy risks in portfolios are deemed to grow in importance pressed by the net-zero pledged by public but also private sector. For instance, in an annual letter to clients, Blackrock, the world largest asset manager, said it was “committed to supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner” and taking a number of steps “to help investors prepare their portfolios for a net-zero world”.

We have worked with few clients in developing and improving a robust funds selection process integrating the latest factors in ESG ratings. Now, we can provide a selection of funds integrating ESG objectives across asset classes. It materialises our commitment to integrate ESG criteria into our analytical process supported by our in-depth research and our long-time experience in sustainable investments. We are able to serve all our customers who have decided to integrate the ESG parameters into their selection of investments.

100 Impact, ESG or SRI funds on watch or selected

in more than 15 sub-asset classes or thematics.

40x ESG criteria already embedded in our selection of Sustainable Investments funds

Winning engagement with prospects and enriching relationship with customers.

Our development goal is based on customers acquisition as well as, and most importantly, by extending the depth and breadth of our services with existing customers. We have been successfully rewarded this year with the onboarding of sizable new customers including private banks in Geneva, but also in Zurich, and the extension of our value-added services into private markets, the production of active thematic indices, and the management of model portfolios.

Financial institutions are keeping considering their operating model in a post pandemic world. They try to create innovative way to operate in a world of fast technology-induced changes with deep impact on financial markets, local regulation increasingly complex, and the inflation of wages and operational costs. For some, to outsource resource-intensive activities such as the qualitative selection of asset managers, or executing due diligence, has become a valid answer to cost saving and gain in efficiency.

We are engaging with customers by delivering tailored solutions in fund portfolio monitoring and risk management, by enhancing their selection process, as well as helping them to match compliance requirements. For many, this has led to a significant improvement in key aspects of their financial services offering, making a real difference.

Outlook

For the year 2022, we reiterate again our view that we expect a challenging time for portfolio managers and asset allocators, but with certainly a larger opportunity set than last year for active managers.

The equity and fixed income asset classes are starting the year again at high valuations while the Federal Reserve is expected to begin rate hikes and others DM central banks have already begun.

Therefore, liquidity restrain might induce deleveraging in markets leading to heighten volatility and limited potential for higher return.

In 2022, we aim to capitalise on the success of our fund selection process, the quality of our due diligence, and to develop a strong platform to give access to private markets to our clients. To achieve that, we will focus on the following:

Model Portfolios

We will seek to partner with well-established data and portfolio management tools providers to bring to wealth managers and financial institutions the flexibility to tailor model portfolios made of carefully selected fund managers, in all kinds of assets and investment thematics.

It is a cost-effective way for those institutions to implement and operate highly diversified portfolios managed by best-in-class managers.

Funds due diligence and analysis

The new financial regulation in Switzerland will require financial institutions, large and small, to re-evaluate their investment selection and risk management to align with stricter compliance requirements.

In this regard, our due diligence and selection capabilities is based on the highest standards of quantitative, but more importantly, qualitative analysis that we have always applied for institutions subject to international regulations.

We reiterate that our objective is to position Wealth Solutions Partners as the partner of choice to support your business successfully and efficiently within the LSFIN/LEFIN framework.

Fund selection for independent wealth managers

We will expand the range of services available on the OpenList platform, which is available exclusively and free of charge to IFMs in Switzerland since 2018.

To this end, a newly designed website will provide access to enriched information on selected funds, including the retransmission of portfolio manager meeting conferences we organise, or portfolio managers’ comments.

We will also promote the Premium version of this service, which is already utilised by some of our clients, and which provides access to our other tailor-made advisory services.

Sustainable investments

We continuously adjust our selection process to integrate the ever evolving regulation and taxonomy in ESG investing to serve customers seeking to combine returns with environmental and social benefits.

In that respect, we have launched in January 2021 a global equity index based on a selection of portfolio managers fulfilling ESG criteria. This unique index will be made replicable for institutional investors or wealth managers wishing to implement such multi-managed, highly transparent portfolio into their mandates.

Private Markets

Finally, through a newly established partnership we have started to provide access to our clients into private markets by using our best practice in investment analysis and our extensive capital raising network.

We have already a highly attractive pipeline of selected deals to introduce to our customers in pre-ipo and real-estate markets.

We will pursue in our goal to improve our analytical skills, by using a combination of AI and big data to leverage our knowledge. We are focusing on building a robust decision-making tool for our customers looking to integrate ESG criteria in their investment process, but also for thematic funds and compliance.

With private banks we will follow closely their business repositioning, to offer our tailored services whenever needed, such as to build value proposition in ESG investments, investment thematics or in specific illiquid markets.

We reiterate here again that we would like to bring to the community of investment professionals, institutional investors and private banks our deep knowledge and extensive experience with the aim to deliver cost effective due diligence, investments research, fund selection and portfolio consulting services in a true open architecture model.

In the current complex world, investment professionals will seek more and more to establish partnerships with knowledgeable, well experienced specialists able to understand and connect them to the world’s best solutions to grow their business successfully. We want to be one of those partners delivering with quality, value, and independence, innovative solutions.

Best Wishes

The WSP Management Team