Research Note

What Investment Grade valuations imply ?

Dear Customers,

Our duty is to keep you updated with the most recent information from our selected Asset Managers regarding their views on current and future market conditions, as well as their current positioning and portfolio activity.

In these difficult period, we will try to communicate as regularly as possible whenever we deem it is relevant and insightful for you and your clients. We strive to be as close to you as possible by giving you this update.

Do let us know should you have any questions, related to those funds or any other in our list.

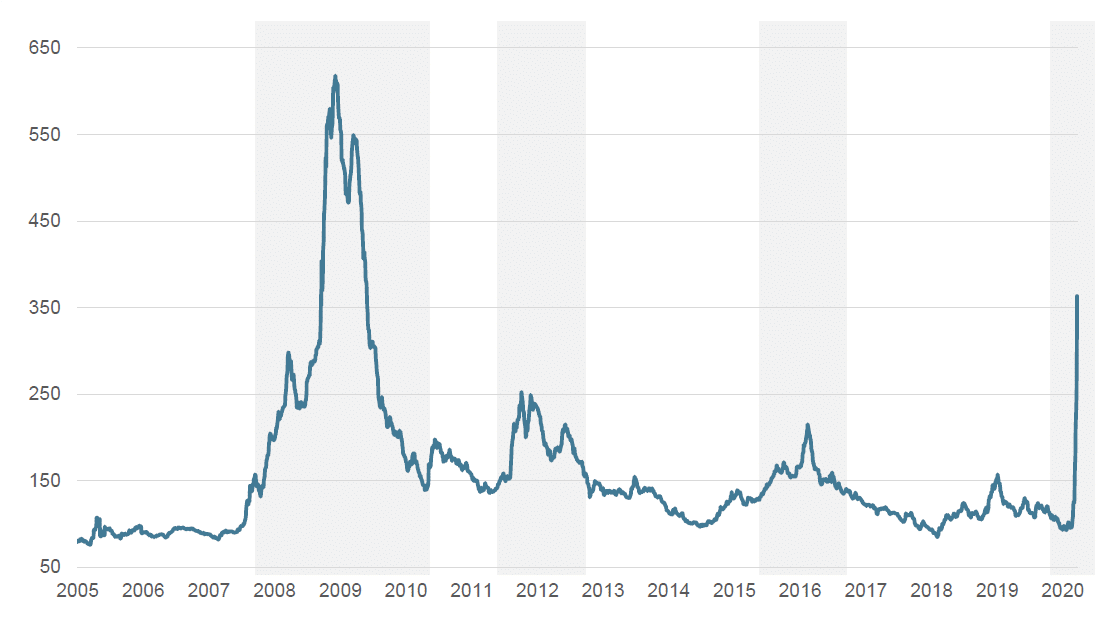

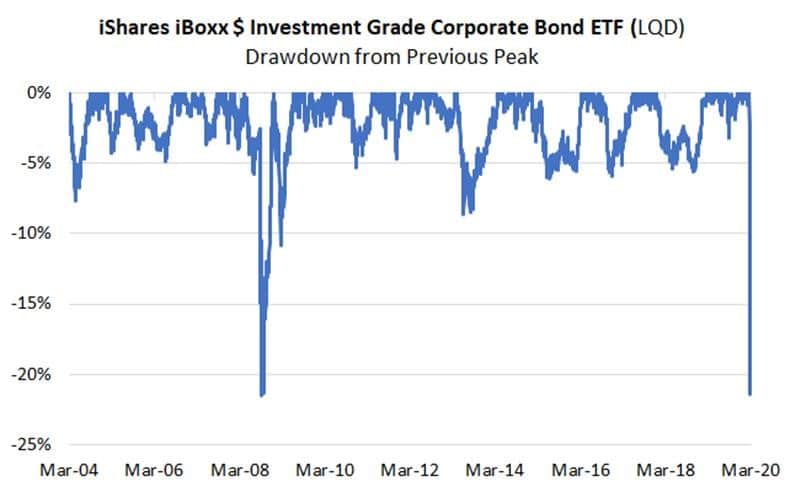

IG Credit has been the relatively worst hurt asset class

- Based on 2019 volatility, we estimate that the current drawdown in the S&P 500 this year is a negative 3 standard-deviation move.

- In HY Credit Spreads, the current drawdown is a negative 5 standard deviation move.

- In IG Corporate credit spreads, the current drawdown is a negative 11 standard deviation move. By this measure, IG credit is the most dislocated market.

- The main change in markets this past week has been a move in the market from an orderly (though steep) sell-off centered on oil and coronavirus exposures, to an indiscriminate sell-off as global investors are selling every asset class from equities, bonds, gold, in order to raise cash. No asset classes have been spared – including corporate bonds — as a lot of forced selling and positions are being unwound. According to Bloomberg a record $36 Billion was pulled from US IG this week alone and almost $15 billion in High Yield year to date.

The resulting credit spread widening on high quality IG bonds has been unprecedented, and discounts required to execute sales have been ranging from 3 to 10%. The extreme widening of the cash bond/CDS “basis” in recent days suggests the wider spreads on cash bonds reflect an increase in the liquidity/funding premium, as opposed to a commensurate increase in underlying issuer default risks.

Central Banks rescue programs

- ECB easing was recently announced via a €750bn purchase program (PEPP) for currently eligible assets, plus certain others including non-financial commercial paper.This translates into an average rate of ~€75bn/month and will be in addition to the €120bn APP announced last week as well as the existing program of €20bn/month.Corporate purchases have so far been 20-25% of the net total and if this trend continues the ECB will buy on average €20-30bn of IG corporate bonds a month (appx. €200-250bn/year).

- The Federal Reserve yesterday announced a major expansion of its lending programs designed to unclog the credit markets, by expanding its facilities to include corporate and municipal debt.Amongst other measures including unlimited purchases of US Treasuries and MBS, the Fed additionally unveiled plans for two new lending facilities to support corporate credit markets:One will lend to investment-grade companies and provide four years bridge financing,

while a second will buy corporate bonds issued by highly rated companies and U.S listed exchange traded funds in the investment grade corporate bond market

WSP Analyst conclusions

While there were nowhere to hide so far in the coronavirus crisis, equities and credit (particularly IG) are pricing different scenarios. The credit market is clearly drawing the darkest one.

Therefore in the process to progressively re-risking portfolios, IG credit, in the wake of the large CB purchase program, could be a great place to start with.

Again, our preference goes for active managers with proven skills in managing credit risks, as the road to recovery might be harsh.

.. get also our latest managers update by

Fund managers who delivered alpha

Their latest comments and positioning

Contact us to request a copy