The abundance of literature written about active versus passive investments is closely linked to the accelerating rise of money poured into passive investments such as ETFs, ETPs, and other passive investment vehicles. The main topic of these literature is to discuss and assess the benefits and threats of investing into one type of portfolio compare to the other. Arguments for and against are thrown out at each other camp.

In this article, we want to take a more pragmatic approach by trying to understand where we are now, what are the risks, and the intended or unintended consequences if such trend is deemed to continue. Does the markets have sufficient auto-regulation mechanisms to reach an equilibrium before going through the extreme of seeing only passive investments available for the majority of investors, – as predicted by many -, creating a considerable systemic risk for the financial markets? We have not made contrasting analysis between bonds and equity, while we acknowledge that notable differences may exist. We think our conclusions would have not been meaningfully different from each asset class treated separately.

Worldwide, there was approximately $715 billion in ETFs by December 2008 and it grew spectacularly from 2009 onward. Worldwide ETF assets nearly doubled between 2008 and 2010, from $715 billion to $1.313 trillion. By the beginning of 2016, total global ETF assets were valued at $3 trillion. To put ETF growth in perspective, the total growth of mutual fund assets between 2001 and 2014 was a cumulative 127%, while ETFs grew by 2,279% over the same period (1).

According to latest data compiled by Bloomberg, the US ETF market, the largest market, has about $2.7 trillion in assets and ETFs have attracted more than $160 billion in new flows so far this year. For instance, equity ETFs account for about 7 percent of the U.S. stock market’s value. While this latest figure seems reasonable, it can be noticed that at the scale of a mutual funds, or a stock ownership, a 7% holding level is considered sufficient to raise “significant” concern over shareholding control risks. Shouldn’t it be the same at the market level?

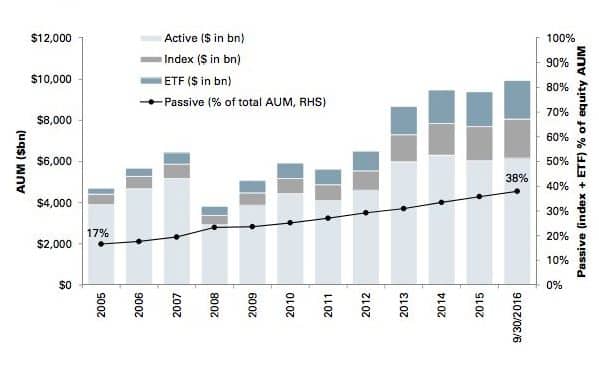

A statistic from Goldman Sachs Global Investment Research shows that:

Passive investing accounts for nearly 40% of total equity AUM in US domiciled collective investments, more than twice the level in 2005.

Source: WS Partners, Strategic Insight, Goldman Sachs Investment Research

It has certainly been justified to invest in passive, cheap ETFs to capture beta performance at the lowest cost in the context of a macro-economic environment driven by central banks injecting massive liquidities to reflate the developed economies.

The unintended consequences

Now let’s examine what could be the unintended consequences of the domination of such style of investment by pushing the exercise to the extreme. First, we remind that, by investing in passive portfolios replicating a broad market index, we intrinsically decide that there is no more need for fundamental research. That we can blindly purchase index funds and ETFs without recognising individual companies’ valuation, and that only collective valuation matters anymore.

If we push that reasoning to the extreme, say by assuming only passive investors make the supply and demand of stocks in the market, hence fixing the stock prices, it would have the consequence to “freeze” forever the relative value of companies between each other’s at the current market cap weight level. Indeed, the flood of money into passive products will make stock prices move in lockstep, disallowing for arbitrage opportunities whenever justified by a change in company’s relative valuation (or risk premia).

The disappearance of relative valuation arbitrage would be rather annoying given that it is a strong postulate in price formation for efficient markets. To notice that this synchronised price move has been already acknowledged by some active managers in the US equity market as a source of market inefficiencies and loss of alpha for them.

We could argue on the contrary, that the valuation anomalies created open considerable opportunities for fewer active managers. However, we think it can only be true as long as enough active managers are left to provide liquidity along those arbitrages process without which the beta from passive flows would ultimately dominate price formation (the old market adage; “don’t fight the trend” will never be as true), making active managers hostage of it and unable to take benefit.

Is it time to be fearful ?

Should we end-up being in that extreme situation, then we agree that the ETFs could become a “weapons of mass destruction “ and “the time to be fearful is now” as recently stated by an active manager in their letter to investors(2) . The question would then be how ETFs will hold up in major market selloff and what would be the impact on investors of markets becoming more vulnerable to severe crashes.

We believe that we are not yet there and the good news is that passive investment opportunities are becoming broader, thanks to a fierce competition between ETF providers, which emulate creativity in passive investment solutions. Now passive investments are no longer limited to major market indices, but there are available for an ever-growing number of strategies, thematics and styles eventually uncorrelated to each other’s.

Investors have the choice to invest also in so called “smart beta” ETFs, replicating semi-active rule based strategies weighted on fundamental variables. These “smart beta” strategies are developed for portfolios investing into stocks or bonds. That diversity of strategies and styles keep open arbitrage opportunities, if not at the individual securities level, at least at the sectors, risk factors or styles levels. We expect that the money flow will spread evenly into these strategies over time.

An equilibrium between passive and active

In conclusion, while we cannot exclude that “..the time to be fearful is now” in a few part of the markets (i.e. fixed income market), which have become vulnerable to selloff potentially magnified by ETFs, we believe however that the financial markets should find some kind of natural equilibrium between active and passive strategies over the long run.

Are we close to that equilibrium? In our opinion, we should not be too far from it. The end of the QE by central banks might mark the end of the attractiveness of beta investments. It might give more opportunities for active managers to prove that alpha still exists and it has its own value in terms of risk management that may better suit investors’ profile and objective. At least, opportunities will exist for managers understanding that cost efficiency was the criteria that drove investors initially into ETFs, and that this criteria will ultimately remain…!!