Fidelity International published recently its annual Analyst Survey for 2017.

The annual Analyst Survey is a forward looking assessment of sectors and regions built entirely from bottom-up. Fidelity analysts conduct around 17’000 company meetings through the year, talking to CEOs, CFOs and division heads. Their survey provides an aggregate measure of sentiment of the companies they cover with a medium-term view .

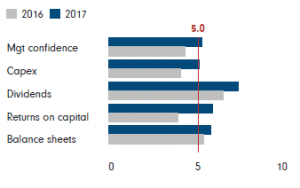

This sentiment indicator is based on 5 factors;

- management confidence,

- capex,

- dividends,

- returns on capital

- and balance sheets.

Then these analysis are aggregated by sectors and regions.

The annual Analyst Survey reveals a corporate environment that’s almost unrecognisable from 2016, marked by renewed corporate confidence in spite of political uncertainty in some key markets.

All analyst sentiment indicator components have strengthened

Source: Fidelity International, February 2017

The aggregate data show positive corporate conditions in all regions and sectors and globally all components of the sentiment indicator have strengthened on 2016.

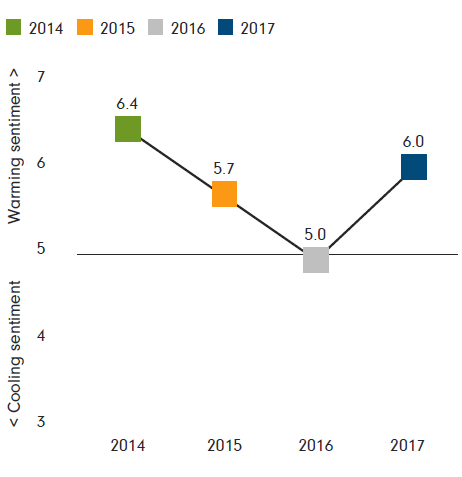

More importantly the sentiment trend that was downward since 2014 is now turning up.

Global Analyst Sentiment Indicator

Source: Fidelity International, February 2017

Inflationary expectations are slowly rising, but leverage is contained

- Leverage is not seen as an issue; balance sheets are robust and very few analysts expect rising default rates.

- Rising leverage in the US is mainly due to shareholder-friendly activities, not operational weakness.

Disruption is on the rise

- Disruption scores are up on 2016.

- IT spending is rising across all sectors

- Major transformations are happening within sectors, affecting IT, consumer discretionary, telecoms, and utilities most.

- With technological innovation spreading and deepening in all sectors, IT comes out strongest, despite itself being disrupted.

Political uncertainty has little impact on strategic planning

- There is little sign of uncertainty weighing on strategic investment decisions despite US policies, European elections, Eurozone cohesion or geopolitics.

- Brexit, however, is weighing on companies’ willingness to invest in the UK, and protectionism is viewed with suspicion everywhere, including in the US.

Key Drivers:

- The demand growth is now the largest driver of earnings growth, whereas it was cost reduction for 2016 survey

- Returns on capital seen recovering

- Analyst sentiment is turning positive on capex, except in China

- ‘Old economy’ sectors such as industrials, materials, utilities, energy are no longer slashing investment

- Analysts expect rising US investment in 2017/18, led by energy

- Dividend strength continues; not a single DM analyst predicts dividend cuts for their sector as a whole

- Inflationary signals strengthen, but only by a little

- Despite much talk about growing global debt, companies generally remain in reasonable or good financial health.

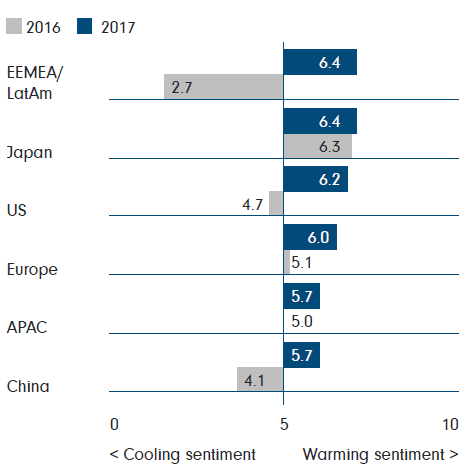

Regional Overview

Global Indicator Breakdown, last 2 yrs

Source: Fidelity International, February 2017

EEMEA/Latam

The largest improvements in the sentiment indicator scores are seen in Eastern Europe, Middle East, Africa and Latin America regions. In 2016 survey, the record low scores were due to slump in commodity prices and its impact on related industries.

Certainly rising oil and commodity prices relive pressures on these economies, even if a stronger dollar can mean tighter financial conditions for emerging markets.

China

After two years of soft readings, analysts renewed confidence in China, due to improving capital returns and balance sheet strength.

Fears of a hard landing have receded considerably.

Asia Pacific (ex Japan, ex China)

This is a very diverse region therefore it’s hard to generalize but the survey reports an improvement in corporate fundamentals across the region. Some countries are benefiting from rising commodity prices but some are suffering from dollar strength.

India stands out as a key market in the region. It has a long-term sustainable economic growth rate around 6-7% according to analysis, driven by positive structural growth factors.

USA

The improvement in management confidence is particularly pronounced in the US. Over half of all analysts see rising confidence and nine out of ten expect stable or higher returns on capital. Companies remain keen to grow their businesses through major M&A deals and almost none of analysts expects dividends to fall.

At the same time, about a third of analysts think leverage is increasing, balance sheets are modestly stretched and funding costs will increase, leading to more bond issuance. However, fewer than one in five sees default rates rising, indicating these pressures are likely to remain contained in 2017.

Europe

Europe’s turnaround also points to accelerating growth in 2017, but the drivers are not quite as broadly based as in the US. European analysts appear more cautious; they see management confidence stable and don’t expect as many major M&A deals as their US counterparts.

Analyst view diverges in terms of return on capital, four in ten expect returns on capital to increase while around a quarter think it may decline.

Japan

There are signs that monetary, fiscal and corporate reflationary policies are having some effect. Japanese analysts are most likely to forecast rising capital spending or growing dividend payments, and nine in ten see stable and rising returns on capital, driven by cost efficiencies.

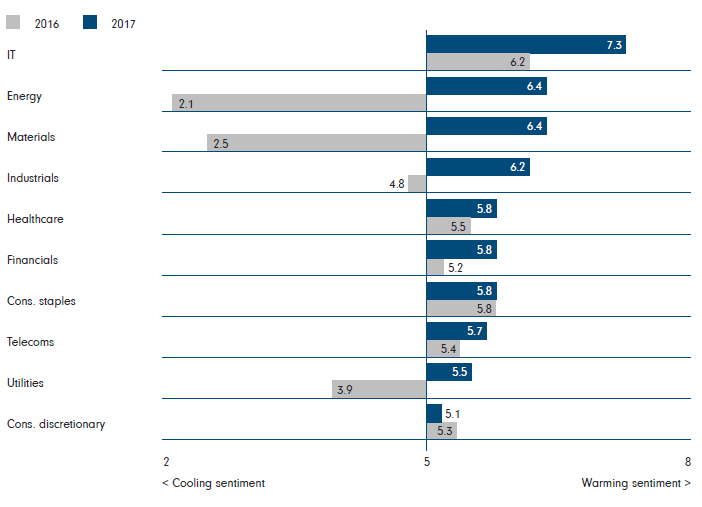

Sector Overview

Global Indicator Breakdown, last 2 yrs

Source: Fidelity International, February 2017

Energy and Materials

There’s a remarkable turnaround in sentiment in energy and materials. Management confidence is significantly stronger than last year and capital sending is expected to recover.

Returns on capital are widely seen to be improving with recovering pricing power in energy and faster growth in demand for materials.

Consumer staples

Analysts have still positive bias towards the sector as these companies generate steady cash flows. But brands are more vulnerable to competition creating operational risk at a time when steepening yield curves are threatening the sector’s ‘bond proxy’ status.

Consumer discretionary

The sector scores lowest on sentiment indicator this year. Analyst sentiment is only very slightly tilted towards improving conditions over the year with declining management confidence, capex and returns on capital.

Spending continues to shift from offline to online everywhere, disrupting existing business models, intensifying competition and squeezing profit margins ever lower.

Information Technology

One of the most interesting findings in the survey is resilience and optimism in IT. More than half of analysts think that confidence is strengthening, feeding through into rising capital expenditure, increasing return on capital and higher dividend payments this year.

Almost without exception, analysts see stable or rising IT spending across sectors and regions. This does not just create work for IT developers; analysts estimate that for every $1 spent on digital innovation, companies will spend another $7 on deploying the solution.

Financials

Overall, analysts are cautiously positive on financials in US, Europe and Japan as company fundamentals slightly improve.

Global economic growth is accelerating, supporting credit quality, banks’ lending activity and margins as well as helping insurers.

Healthcare

Healthcare remains one of the analysts favored sectors. Over recent years markets have anticipated rising earnings as research and innovation led to new treatments and medicines, but analysts think the sector’s medium term earnings potential may still be underestimated.

Risks and Takeways

The survey results show how important oil prices still are to global economy. It’s possible that oil prices slide again, forcing another round of adjustment in the energy sector and rippling through other sectors and economies, or that demand growth disappoints.These are significant potential threats to cyclical upturn story.

Meanwhile, a resurgence of inflation, largely in the US and UK, could lead to tighter financial conditions globally, which could hurt many companies. However above all analysts are more concerned about demand. Demand slowdown is seen as the biggest risk factor to the fundamentals in each sector.

In summary three big risk factors are oil price fall, disappointing demand and tighter monetary policy in response to resurgence of inflation.

Surprisingly analysts do not see significant impact from political risk, with the exception of Brexit. More than half of European analysts warn that their companies are less willing to invest in the UK as a result of referendum.

The key takeway from this very comprehensive survey, we highly recommend to read:

‘ Business models are changing with further industry consolidation on the cards.’

Source: Fidelity Analyst Survey 2017