The JPMorgan Corporate Emerging Market Bond Index performed by 7.96% in USD last year. Although the rally has been impressive, we think that the fundamentals and the valuations will remain supportive.

Improving fundamentals: Companies are focusing on deleveraging

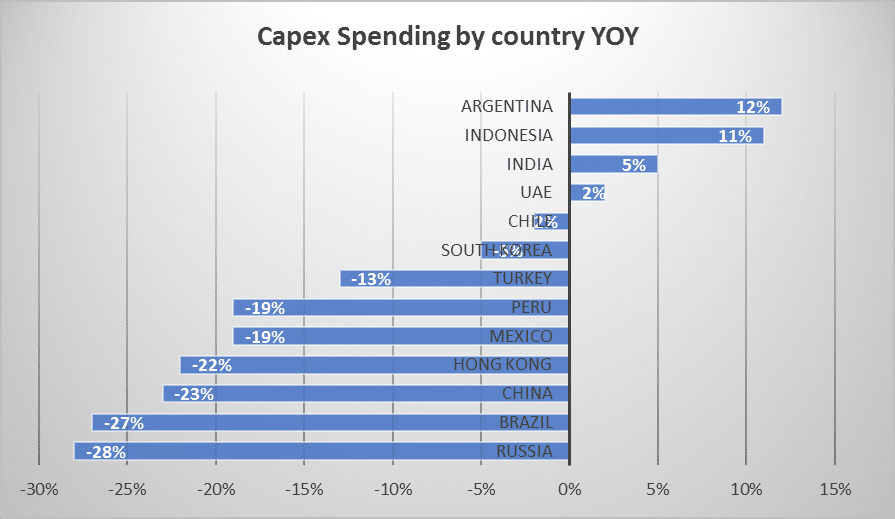

Leverage levels of the corporates in EM space are stabilizing. The increase in leverage over the last several years among EM corporates was a result of many factors, ranging from investments for their businesses growth to the prolonged period of weak commodities and currencies. For many companies, especially in the energy and mining sectors, the combination of low commodity prices and declining demand dramatically depressed revenues and earnings, limiting the companies’ ability to pay off obligations and ultimately resulting in higher leverage. The corporate sector responded to this crisis with across the-board cost-cutting initiatives, severe capex cuts and asset sales.

Source: Barings

In addition, there were some concern among investors around the amount of EM corporate debt that is set to mature in the next few years. While it is true that maturities are on track to accelerate in 2017 and 2018, most the upcoming debt maturities are from companies rated investment grade. Moreover, debt maturities are dominated by Asian issuers which would benefit from a better operating environment and access to capital and liquidity.

Attractive valuation

Due to their shorter maturities and higher coupons, EM corporate debt has shown lower sensitivity to U.S. rates than US or European corporates. EM Corporates also offer an attractive spread relative to developed market fixed income asset classes. Over the last five years, EM investment grade corporates—which make up more than 60% of the EM corporate debt market—have offered an average spread of 143 bps over U.S. investment grade corporate bonds. Even after the large rally since February of 2016 the current spread differential between EM Corporate and US IG Corporate at 160bps remains higher than the historical average.

Source: JP Morgan CEMBI BD Index, JP Morgan GBI-EM GD, JP Morgan EMBI GD, Barclays US Corporate HY Index,

BofA Merrill Lynch European Currency Constrained, JP Morgan Global HY Index, Barclays Euro-Aggregate Corporate Index,

Barclays U.S. Corporate Index, Barclays Global Aggregate Corporate, as of 31.12.2016

With that in mind, we think that the Corporate EM debt could be the best pick within the traditional Fixed Income asset classes in 2017. As idiosyncratic risks and political issues will remain elevated, we also believe that active management will be paramount. While the Portfolio Manager’s turnover in the asset class has been high in recent years, we favour two strategies with experienced PMs, backed by a well-staffed team and with a team-approach culture. The first one is a core portfolio with a relatively concentrated portfolio while the second one is more high-yield oriented with a pocket of strong recovery value holdings.