Wishing you and your loved ones a healthy, enjoyable, and prosperous Year 2021

How do you feel after the shortest “bear market” in history in 2020 ? us, not so bad

The year 2020 has proved to be one of the most exceptional years in history in many areas. No need to remind you again why, just to retain the most evident; a pandemic of unprecedented consequences for life and economies since World War Two, a surreal US presidential election, and last, but not least, massive monetary injections by central banks. Despite all those events and uncertainties, financial markets managed to stay resilient, eventually ending the year at record highs, much better than feared.

Abundant liquidity, and optimism about the roll-out of Covid vaccines all supported investor sentiment and risk appetite after Q2 2020. Central bank again by staying accommodative have driven the price of risky assets higher, and as we already expected at the end of last year for 2020, it should not stop either in 2021 while certainly at a more restrained pace.

For 2021 we can assume that a fast rate recovery in global GDP may be the central theme to retain. After the huge slump in GDP last year, most economists expect that global GDP will return to either pre-virus level, or slightly below, either in the first half of the year for the more optimistic, or by the end of the year for the more cautious ones. Of course, we should expect a wide variation in economic recovery rates across regions and countries given that the pandemic stroke particularly hard some economies while others have already recovered (i.e. China).

Combine this to the massive liquidity still made available by central banks, risky assets should continue to be well supported but in a volatile environment, marred by brutal shifts in allocation due to the already prevailing (too?) rich valuation for many assets.

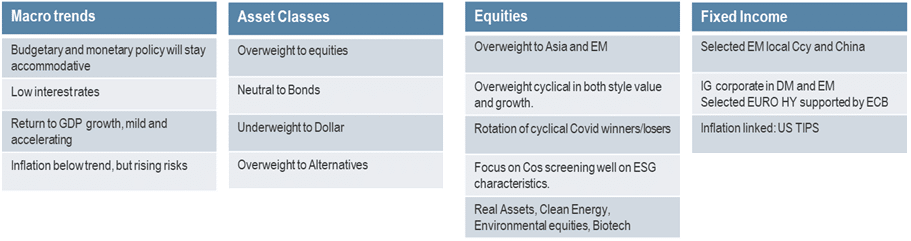

We have summarised here below the key investment themes retained by a selection of fund managers we follow. We hope it will give you a useful insight on where seasoned portfolio managers are planning to put money at work this year:

Like for wine; the more stressful the weather, the more exceptional the vintage can be. 2020 is set to become a vintage of anthology in alpha creation by active fund managers.

Most fund categories recorded positive returns for 2020 in absolute terms, and despite a very volatile environment, many active fund managers achieved record high alpha. In 2020, approximately two-thirds (67.4%) of active European equity funds (according to the Morningstar classification) outperformed their benchmarks, double the 33.8% in 2019, which was already an improvement on the previous year. Alpha has been well spread across market capitalization and style (growth/blend/value).

Surprisingly, the same trend can be observed for US equity market, historically dominated by ETFs and passive solutions. Nearly half of US active equity funds (44.8%) outperformed their respective benchmarks. Alpha generation has been robust in US small and mid-caps funds and less obvious in large cap growth funds, more skewed towards the FAANGs that displayed outstanding yearly returns. In Emerging markets, China was the winning bet in most portfolios, with 41.7% outperforming their reference index.

Beyond this positive picture for active management, largely above historical numbers, the more striking remains the magnitude of the performance’s dispersion within each peer groups between “winners and losers”. For illustrative purpose, the average alpha generation for funds investing in Developed Markets equities, across all regions, market capitalization and style is above 10% in 2020. Some funds achieved triple-digit returns and outperformed their benchmark by more than 100%. Definitely, a year for history.

Of course, by analysing further we will notice that momentum play, high concentration coupled with style biases may have acted an important role to achieve such results. Nevertheless, active stocks selection or credit selection, well executed market timing, sound risk management, or robust systematic investment processes have also positively contributed for the most skilled fund managers.

Our selection of funds again delivered remarkable Alpha over short and long period.

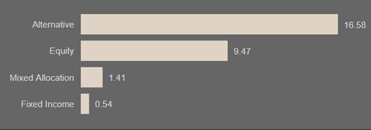

Alpha creation in our selection has been very satisfactory. As described above, fund managers have recorded historical high alpha in most asset classes. Alpha has been a solid +530bps in average across all asset classes, with +947bps for equity funds alone, while fixed income funds achieved good but mixed results at +54bps of alpha in average, ranging from +126bps to -103bps, depending on the benchmark considered. In the alternative UCITS funds, the outperformance has been an incredible +1658bps in average, an impressive result due to a long/short equity fund that delivered outstanding performance, well above its peers.

Selected funds : +530bps average excess return in 2020.

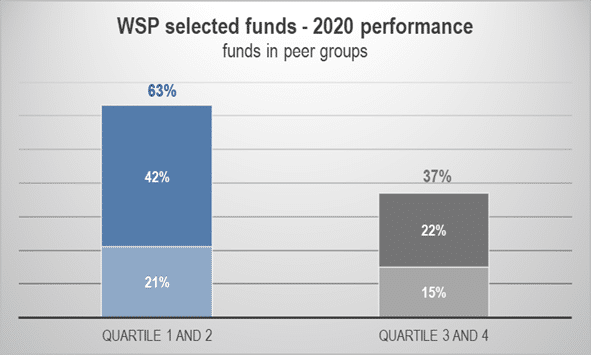

Compared to peer groups, our selection stayed at the top for 2020

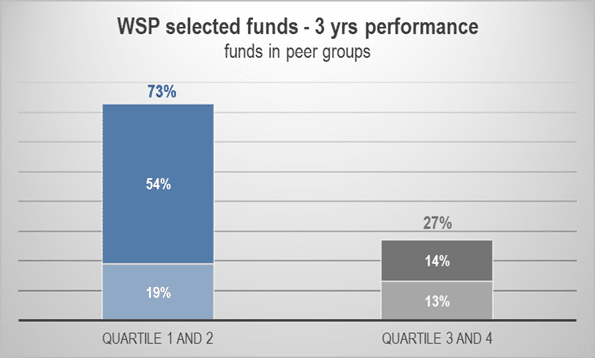

Most fund returns are in the first and second quartile of their categories. The results are even more remarkable if we consider the 3-year performance period, the standard measure for evaluating a fund manager’s performance:

In 2020, 63% of the selected funds achieved an annual performance in the first or second quartile of their peer group (graph 1), while 73% of them ranked in the same quartiles over three years performance (graph 2).

Chart 1 – WSP selection universe – 1 yr return ranking

Chart 2 – 3yrs return ranking

Once again, 2020 was a particularly challenging period for active management with an unprecedented market correction followed by a sharp rebound. In that context we are proud to see that our selection of active fund managers has been resilient in delivering steady alpha.

WSP Selection includes more than 120 funds, across 72 strategies in equity, fixed income, alternative asset classes and ESG/SRI, selected

from a universe of more than 50 asset managers.

Already 25 Sustainable Investments funds across 15 sub asset classes have been added to it.

Watch list is still at more than 90 funds of interest to us, either for their unique strategy or process.

Model Portfolios of active funds have delivered robust alpha

2020 has been a great year for alpha generation, particularly for equity strategies. Our model portfolios took profit from this favourable environment to significantly outperform their respective reference benchmarks.

We have developed and managed various model portfolios made of active funds exclusively for our client with the aim to deliver superior returns from markets and alpha generation.

The oldest portfolios have been launched more than 5 years ago: Three multi-asset portfolio profiles in two base currencies; US dollar and Euro.

Yield & Income Portfolio (2/3 fixed income – 1/3 equities), the most conservative strategy, gained +14,0% in 2020 (USD) vs. +9.4% for its benchmark (2/3 Barclays Global Agg – 1/3 MSCI All Countries).

Balanced Portfolio (1/3 fixed income – 1/3 absolute return – 1/3 equities) performed by +12.9% against +11.2% for a 50% Barclays and 50% MSCI benchmark.

Growth Portfolio (1/3 fixed income 2/3 equities) strongly outperformed its benchmark by +490bps in 2020 (+17.7% vs. 12.8% in USD).

As a reminder, all strategies are 100% invested at all times and the balance between fixed income and equities remains unchanged. As a result, most of the relative performances are coming from the alpha generated by the selected funds.

Full results and comments are available in the January 2021 Performance Report published in our news web page.

Income Alternative portfolio, managed since January 2019, is a portfolio mostly focused on private debt with the aim to capture the available liquidity premium to deliver libor +4% return with minimal volatility, thanks to a diversified portfolio of stable income-oriented funds. We seek strategies from which, most of the performance is generated by their income with relatively short maturities such as; trade finance, bridge loans, litigation, supply chain financing, peer-to-peer lending. It results in a portfolio returning +6,9% in 2019 (USD) and +3.7% as of 30.11.2020 with a volatility of 2.7%.

Thematic Equity portfolio, launched in January 2019, is a portfolio aimed to outperform the MSCI ACWI. It invests through funds in 12 underlying themes or megatrends to achieve a well-diversified equity allocation. The portfolio outperforms its benchmark by +1240bps since inception (+55.3% vs. 42.9% in USD) and by +850bps in 2020 (+24.7% vs. 16.2% in USD). This performance has been achieved with lower volatility, drawdown and beta than the index. The portfolio focuses on the quality of stock selection by the underlying fund managers and a risk-based portfolio construction.

ESG funds selection and research

We are proud to have gain trust from our largest customer to provide them a selection of funds with ESG objectives in equity and fixed income asset classes. It materialises our continuous effort to integrate ESG criteria into our analytical process supported by our in-depth research and our long-time experience in sustainable investments. We are now able to serve all our customers who have decided to integrate the ESG parameters into their selection of investments.

100 Impact, ESG or SRI funds on watch or selected

in more than 15 sub-asset classes or thematics.

40x ESG criteria already embedded in our selection of Sustainable Investments funds

Successful engagement with customers and prospects despite exceptional circumstances

We have a goal to develop our activity not only by new customers acquisition, but also by extending the breadth and depth of our services with our existing customers. The year 2020 was particularly challenging in that respect by imposing hard restrictions in meetings, travelling, or more broadly on limiting social interaction. It has been evidenced that homeworking does not facilitate engagement by stakeholders in new activities or in projects management. In that context of limited interaction, it is harder to bring new solutions or to reach to a consensus for new services.

We have followed the trend by making extensive use of videoconferencing capabilities to keep in touch with our customers and prospects, as well as to discuss new opportunities with them and even close deals through this means. This period has certainly contributed to speeding up our digital communication implementation, and we believe that there is always significant progress to be made in this area. It will help improve our service capabilities.

We observed with interest that many financial institutions are re-evaluating their business model in the wake of the situation of forced confinement and home-based work. They have become aware of the value of outsourcing specific activities such as selection of asset managers or due diligence, thereby saving costs in the process while gaining in efficiency. We are particularly pleased with this development.

We engaged with many of our customers to deliver tailored solutions in fund portfolio monitoring and risk management, enhancing their selection process, as well as helping them to match compliance requirements. For all, it translated into a decisive improvement in many aspects of their financial services offering, it was a true game changer.

Outlook

For the year 2021, we will reiterate what we said 12 months ago, that we expect a difficult period for asset allocators due to the main asset classes; equities and fixed income, entering the year at high valuations, with risk assets mostly “priced to perfection”. Therefore, to generate high returns it will be essential to stay selective and ready to navigate between asset classes, sectors and style rotation.

As we have all noticed, the world has become a little more complicated for many since the beginning of the COVID 19 pandemic. It is now difficult to say “business as usual” !!. All companies in all sectors have been affected, they have had to rethink their business model or find new ways to address their market. We have not been immune to this exercise. However, as we believe that every new situation brings its opportunities, we have adapted our business accordingly and remain optimistic for the coming year. Some good news on the side of virus eradication should help to return to a better life and ultimately a more business-friendly environment.

In 2021, to capitalise on the success of our fund selection process and the quality of our due diligence, we will focus on the following developments:

Model Portfolios

We will grow our support to wealth managers and financial institutions who want to offer to their clients tailored portfolios, made of carefully selected fund managers, in all kind of assets and investment thematic.

It is a cost-effective way for those institutions to implement and operate highly diversified portfolios managed by best-in-class managers.

Funds analysis and funds due diligence

The new financial regulations in Switzerland will require financial institutions, large and small, to re-evaluate their investment selection or risk management processes to bring them into line with stricter compliance requirements.

In this regard, we will strengthen our due diligence or selection capabilities, which have always been based on the highest standards of quantitative and qualitative analysis we have applied in institutions subject to international regulations.

We reiterate that our objective is to position Wealth Solutions Partners as the partner of choice to support your business successfully and efficiently within the LSFIN/LEFIN framework.

Fund selection for independent wealth managers

We will expand the range of services available on the OpenList platform, which is available exclusively and free of charge to IFMs in Switzerland since 2018.

To this end, a newly designed website will provide access to enriched information on selected funds, including the retransmission of portfolio manager meeting conferences we organise, or portfolio managers’ comments.

We will also promote the Premium version of this service, which is already utilised by some of our clients, and which provides access to our other tailor-made advisory services.

Sustainable investments

We will reinforce our service offering in ESG investment selection to accommodate growing interest by our customers seeking to combine returns with environmental and social benefits.

In that respect, we have launched a global equity index based on a selection of portfolio managers fulfilling ESG criteria. This unique index will be made replicable for institutional investors or wealth managers wishing to implement such multi-managed, highly transparent portfolio into their mandates.

Otherwise, we will center our selection on Thematics, ESG investments, Cash enhancer and absolute return funds demonstrating robust risk return profiles. As well, we will look for funds featuring attractive liquidity premiums able to deliver the high yields desperately sought after by investors.

We will pursue in our goal to improve our analytical skills, by building tools using a combination of AI and big data to leverage our knowledge. We will focus that effort on building a robust decision-making tool for our customers looking to integrate ESG criteria in their investment process, but also for thematic funds and compliance.

With private banks we will follow closely their business repositioning, to offer our tailored services whenever needed, such as to build value proposition in ESG investments, investment thematics or in specific illiquid markets.

We reiterate here again that we would like to bring to the Swiss investment professionals, the institutional investors and private banks communities our deep knowledge and extensive experience in delivering cost effective due diligence, fund selection and portfolio consulting services in a true open architecture model.

In the current complex world, investment professionals will seek more and more to establish partnerships with knowledgeable, well experienced specialists able to understand and connect them to the world’s best solutions to grow their business successfully. We want to be one of those partners delivering with quality, value, and independence, innovative solutions.

Best Wishes

The WSP Management Team